- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

I'm starting to wonder if anyone on this forum is legit when they can't run a backtest and bar replay.

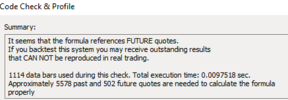

Or perhaps it's just that people don't read properly. The period is very low, p = 0.0001, and there's a 1 day delay.

Or maybe it's that some people can't admit being wrong.

Or maybe it's just a team sport. Skate is my online buddy, so I will agree with everything he says, and not bother to check anything myself.

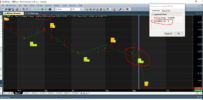

Is there anyone here who has run the backtest using my code? If not, how can you argue that zz can't be used safely in a backest? Just because some website says "don't use it!" doesn't mean that's the final word. DYOR and stop believing what others say.

Last edited: