- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

The timeless words of Buddha when it comes to trading

"Inflamed by greed, incensed by hate, confused by delusion"

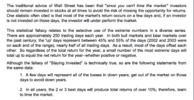

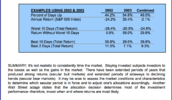

1. Greed

Is an insatiable longing for more & more. Greed is a damaging emotion, especially in trading volatile markets. During these times traders need to control their urges or instincts. When left unmanaged, greed can expose you to high-risk situations.

2. Hatred

The symptoms of hatred can show up as anger. Trading when angry never ends well. Once the feeling of anger raises its ugly head, trading skillfully goes out the window.

3. Delusion

Basically, delusion separates good traders from all the rest. When you haven't got a grip on reality, you don't have a clear-cut path to positivity. Those who display delusional tendencies would do well to remember that "trading performance is a measurement of doing all the little things well".

Skate.

"Inflamed by greed, incensed by hate, confused by delusion"

1. Greed

Is an insatiable longing for more & more. Greed is a damaging emotion, especially in trading volatile markets. During these times traders need to control their urges or instincts. When left unmanaged, greed can expose you to high-risk situations.

2. Hatred

The symptoms of hatred can show up as anger. Trading when angry never ends well. Once the feeling of anger raises its ugly head, trading skillfully goes out the window.

3. Delusion

Basically, delusion separates good traders from all the rest. When you haven't got a grip on reality, you don't have a clear-cut path to positivity. Those who display delusional tendencies would do well to remember that "trading performance is a measurement of doing all the little things well".

Skate.