Dump it Here

- Thread starter Skate

- Start date

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Go back a month or so on Nick’s US intra-day and he had some big losses, which only a seasoned trader like Nick could stomach and continue on tradingDo you use any intraday strategies?

Are your systems long only?

There are many intra trading opportunities to be had, especially around earnings season - now i guess most of your systems are systems i.e. systematic, but even so, there are many intra day system, mean reversion etc, have you seen Radge (US) MR performance today (last night) ??

View attachment 138161

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

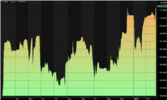

This is a great example of faith in your systems and removing the emotion from your head when trading.

Couple of posts from Nick...check out his YTD P&L which he posted on 12 Feb. The second pic which he posted a few hours ago show he's still in the red but is clawing back a lot of his mid Feb losses.

Not many would stick with that.

Couple of posts from Nick...check out his YTD P&L which he posted on 12 Feb. The second pic which he posted a few hours ago show he's still in the red but is clawing back a lot of his mid Feb losses.

Not many would stick with that.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

It's not about timing the market...it's about time in the market.

Trading is a tough gig

These last few months would test any new trader as it's not been the most optimal time to trade. Even seasoned traders are not happy but it's nothing that we haven't seen before. Rest assured the good times will return, hanging in there will test your mettle. Your ability to cope well when difficult trading conditions persist may be the ultimate decider if you will be a profitable trader or not.

12th February 2022 to 24th February 2022

Nice recovery

Skate.

- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,066

Nice to know what they were! I guess you need to pay for a sub?12th February 2022 to 24th February 2022

Nice recovery

- Joined

- 26 May 2009

- Posts

- 45

- Reactions

- 42

thanks Dave,That would be Nicks Daytrading system not his MR system.

Do you know anything about Nick's MR system, he mentions the code is open source but i cannot find any link to the source code.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Open source does not equal free. You gotta pay him to get access to the source codethanks Dave,

Do you know anything about Nick's MR system, he mentions the code is open source but i cannot find any link to the source code.

- Joined

- 26 May 2009

- Posts

- 45

- Reactions

- 42

obviously he sells this product, but...Open source does not equal free. You gotta pay him to get access to the source code

open source

- denoting software for which the original source code is made freely available and may be redistributed and modified.

i'm guessing what he actually means is the code is viewable/editable by the purchaser and not open source in the traditional meaning, better maybe to say the user can edit the code directly or something like that.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Understand…but Nick doesn’t subscribe to that definition. Like I said, pay him and he’ll give you the source code. His definition of open source also does not allow you to distribute your derivative works from his source codeobviously he sells this product, but...

open source

- denoting software for which the original source code is made freely available and may be redistributed and modified.

i'm guessing what he actually means is the code is viewable/editable by the purchaser and not open source in the traditional meaning, better maybe to say the user can edit the code directly or something like that.

pay him

MEAN REVERSION STRATEGY FOR AMIBROKER

Mean Reversion strategy to profit from short term price movements; Buy strongly trending stocks experiencing brief periods of weakness.

...but that's not the US HFT system.

That would be a subscription with compulsory steel balls.

MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Must admit I’m not up on what Nick sells as subscription and turnkey. I guess I was just highlighting that Nick’s “open source” turnkey systems are not free. Most folks automatically assume open source equals free

MEAN REVERSION STRATEGY FOR AMIBROKER

Mean Reversion strategy to profit from short term price movements; Buy strongly trending stocks experiencing brief periods of weakness.www.thechartist.com.au

...but that's not the US HFT system.

That would be a subscription with compulsory steel balls.

thanks Dave,

Do you know anything about Nick's MR system, he mentions the code is open source but i cannot find any link to the source code.

As @MovingAverage says, the source code is not free.

I would definately not call it open source either because you are not allowed to share it ( you have to sign an NDA ), but you can modify it at your discretion.

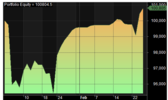

For a comparison i just ran a backtest from Nicks stock code from year to date. I was interested to see how his turnkeys were travelling through this 2 month period.

$SPX ( 1/1/22 O = 4778 ... 25/2/22 C = 4384 YTD -8.24% )

Nicks MR Unmodified ( US )

Nicks DayTrade LONG Unmodified ( RUI 25% margin)

Nicks Daytrade SHORT Unmodified ( RUI 25% margin )

Nicks WTT Unmodified ( ASX )

Nicks Large Cap MOMO Unmodified ( ASX 100 ).

He publishes his long term results on his site so i won't repeat them here.

The US market is currently down 8.24% and ASX 6.5% YTD,

Discounting the 2 day trading strategies the MR is the only system holding it's head above the waterline (just), The MR's performance to date for the year is ahead of the 2 trend following/momentum systems which isn't surprising given the market. It is also beating his premium portfolio, ASX momo and US momo.

BUT ....... We are looking at a particular point in time with a specific set of conditions. For long term performance through broader market conditions you really should go to his site and study the results of his systems over a longer time period, they're all freely available.

*** Daytrading strategies should be discounted because they are NOT something that come ready to run out of a box.

I am NOT advocating Nicks systems. I don't run any of them and i don't think Nick does either, at least not in their turnkey form.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

For a comparison i just ran a backtest from Nicks stock code from year to date.

@DaveDaGr8 that's an excellent post with great content for a short evaluation of Nick's turnkey strategies. If it's not too much trouble would you also do the same comparison with a backtest period of (365-days) & two years backtest?

So the backtest is not cherry-picked - the one & two years backtest should start & conclude with the 28th February. Doing so allows others & myself to evaluate professionally written code in relation to their own efforts.

Skate.

- Joined

- 26 May 2009

- Posts

- 45

- Reactions

- 42

Thank you for running those comparisons on the 2/12/24 month backtests.Daytrading strategies should be discounted because they are NOT something that come ready to run out of a box.

I am NOT advocating Nicks systems. I don't run any of them and i don't think Nick does either, at least not in their turnkey form.

The performance of the US LONG daytrade is very solid from what i can see here.

What do you mean the daytrading strategies should be discounted ... "they are NOT something that come ready to run out of a box" d'you mean the chartist api also needs to be purchased or do you mean something else ??

Yes i see this often, individuals not advocating for turnkey code defaults, i guess most purchasers tweak to avoid anyone gaming the signals; i know Nick also has mentioned he has his own tweaks on these, so it's essentially purchasing a broad canvass on a trading approach from which each individual can tweak for their own needs.

- Joined

- 28 March 2016

- Posts

- 17

- Reactions

- 10

For a comparison i just ran a backtest from Nicks stock code from year to date. I was interested to see how his turnkeys were travelling through this 2 month period.

$SPX ( 1/1/22 O = 4778 ... 25/2/22 C = 4384 YTD -8.24% )

View attachment 138295

Can you please demystify what "SPX" is

Yes the US DT is a rock solid performer and it can be tweaked a bit.

The majority of people here don't talk about them and don't seem interested in them.

Yes you need to setup a whole infrastructure framework. IB, an API, Norgate, amibroker all built in a custom VPS. Nick has posted a video on it with some pretty simple go to instructions.

I spend almost NO time anymore looking at the mechanics of daytrading, it's mostly all automated. I could walk out on Monday and come back on Friday and hopefully it's still ticking away.

What i spend my time doing is looking at the reports of anomalies if there are any, then tracing and downloading minute or tick data and piecing together WHY something didn't work the way it should have.

The other thing i do is look at potential flaws and weaknesses that can break and take down the system ? when will i get hacked ? how can i slow down a hacker ? Having a system online 24/7 exposes you to the world.

To be honest that's just looking at the rabbit hole. Once you fall in it you'll realise just how deep it goes.

Just to reiterate .... I DON'T run Nicks daytrading strategy or any of the other turnkey strategies.

The majority of people here don't talk about them and don't seem interested in them.

Yes you need to setup a whole infrastructure framework. IB, an API, Norgate, amibroker all built in a custom VPS. Nick has posted a video on it with some pretty simple go to instructions.

I spend almost NO time anymore looking at the mechanics of daytrading, it's mostly all automated. I could walk out on Monday and come back on Friday and hopefully it's still ticking away.

What i spend my time doing is looking at the reports of anomalies if there are any, then tracing and downloading minute or tick data and piecing together WHY something didn't work the way it should have.

The other thing i do is look at potential flaws and weaknesses that can break and take down the system ? when will i get hacked ? how can i slow down a hacker ? Having a system online 24/7 exposes you to the world.

To be honest that's just looking at the rabbit hole. Once you fall in it you'll realise just how deep it goes.

Just to reiterate .... I DON'T run Nicks daytrading strategy or any of the other turnkey strategies.

Similar threads

- Poll

- Replies

- 258

- Views

- 23K