- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

ive spent the last couple of weeks working and learning amibroker and started with your WTT code. its been a really nice learning process.

Back in the old days

The year was late 2014 or early 2015 @captain black gave me a simple weekly breakout strategy to play around with. The kindness of the Captain got me started in figuring out what was required to trade systematically. Back on the 13th November 2020, I was revisiting old strategies I traded back in my early days. The strategy was the "BlueWren Strategy" & with additional knowledge improvements flowed.

I was looking to trade another strategy

I'm surprised that a simple breakout strategy still works efficiently with today's volatility. The resurrected strategy has been trading for 9 weeks with pleasing results.

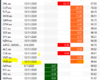

The results below are from "live trading" (not backtest results)

The BlueWren Strategy is 20 positions $100k portfolio (bet size $5k)

It's worth remembering

The kindness of others should never be underestimated.

Skate.