- Joined

- 13 February 2006

- Posts

- 5,427

- Reactions

- 12,692

Thanks @Skate for the update.

Quick question in regards to today's purchase PLS.

Is the purchase price correct at 0.43 or is it a typo as I can't see that it got down to that price on my chart.

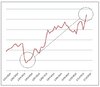

I'm posting a snippet of an equity curve of one of my portfolios. I'm doing this to reinforce a point that is often made by experienced traders/investors and is overlooked by beginners. I'm also doing this as I'm feeling very satisfied with the work I've done in this portfolio.

The point: Trading profitably is a high performance activity and at the elite level it's predominantly psychological. We know that two people trading the same system can get very different results. The difference is due to the mindsets of the traders. It's been a difficult year for many of us, myself included.

I think the profit factor below is not entirely accurate, or rather, not entirely representative of the system. Why? Well, as soon as I started I had all my stops hit due to the COVID crash. Needless to say, the current win% is pretty good and shows how I clawed back after an immediate and large drawdown from the beginning. (At least that's my justification haha)

www.aussiestockforums.com

www.aussiestockforums.com

Weekly Portfolio - ASX

Week 36 Buy: 12 buys Sell: 1 stale exit Index is up. The XAO gained a lot this week. According to my spreadsheet I gained 3%. Not bad since I'm only 25% invested. According to my current spreadsheet I'm at -3.06% but according to Share Trade Tracker I would be out of drawdown. Something to...www.aussiestockforums.com

It's refreshing

When members post graphics or trading results as @peter2 & @Warr87 it gives junior members a glimpse into the life of those who actually trade - in the vein of helping others benchmark their own trading results & frankly I'm no different. Sharing information is a way that helps others understand trading a little better.

Benchmarking

2020 has been a challenging trading year. Indicivisness & indecision raised its ugly head when COVID-19 "flash crash" hit with a vengeance - most traders (a) didn't know whether to sit on the sideline or (b) keep having a go, trading through the turbulent times. With some, it was a combination of both.

Charts & results

The recent charts & trading results concentrate on the period from "Jan/Feb 2020" to the results achieved so far this week. In the spirit of sharing, I'll post my equity curve for the same period so others understand how trying it was to trade through a period of uncertainty. Looking over & comparing results from different traders can help crystalise what can be achieved from experienced traders.

It's been tough

A win rate of 39% on face value seems low but in a very volatile trading environment, it's not too shabby. The "Profit Factor" of 2.32 was hard-fought to achieve. It goes to prove if you - "Win more when you win than you lose when you lose" you are halfway there as a half-decent trader.

View attachment 114443

Skate.

I don't know how you still kept that profit factor, lol. Your systems were always more responsive than mine. It took me until August to get back to breakeven, which I am taking as a win. The latest market hasn't been kind either. Right back into a drawdown again. I would characterise the current market as volatile sideways.

Horses for courses

@Warr87 I trade multiple strategies & I'm prepared to display each strategy separately in descending order. The first graphic is a combination of my trading strategies. It clearly proves that not all strategies are created equal.

To be fair

Each strategy has a defined job so we are comparing apples & oranges.

FYI

I have 4 parked strategies at the moment that have traded in the past waiting for the ideal conditions to reactivate.

This graphic is a combination of my trading strategies

View attachment 114464

Strategies are displayed in descending order that needs "Clarification"

Strategy 1 = is my "Buy & Hold" Strategy

Strategy 2 = is my "LIC Investment" Strategy

View attachment 114465

# Clarification 2

Strategy 3 to 8 are my active trading strategies

View attachment 114466

View attachment 114467

View attachment 114468

The market has been roaring since 6th March 2020

During this period there were a few minor setbacks - but that was expected as "it's just the nature of a recovering market" (@ducati916 has covered this extensively in his thread)

View attachment 114469

Skate.

View attachment 114456

I would disagree with that it is predominantly psychological. Trading at the elite level is, I would argue skill based. The skill required is a designed/built methodology/strategy. At the elite level, everyone is expected to manage psychological issues professionally, unless the system traded is predicated on psychology, then and only then, would a psychological flaw reveal itself, resulting in returns below that which would be expected. As an example, Taleb's style of trading (now managed exclusively by his business partner). This is a purely psychological way of trading, hundreds if not thousands of small losses waiting for the gargantuan win.

Success, which vaults you into the elite level is predicated upon the skill in building/designing a system of trading that consistently, in any market conditions, returns a profit.

There are many styles and niches available to create consistent profits. Mechanical systems are a primary example of a niche style of trading. Taking for the moment, long only systems (which seem to predominate for obvious reasons) are all systems equal in their returns? Most mechanical systems run backtests...are those backtests equivalent? Without even looking at them, I would wager 10c that they are not. Can above average psychological intervention improve a bad system? Probably not. Therefore, improving the system is paramount. Trust me on this, it is a lot easier psychologically to trade a really profitable method than a horrible one.

You saw Peter studying the entry charts of Mr Skate's system, looking to improve (if possible) his system. That is someone seeking continued improvement in skill...not psychology. That is what is required. Executing trades based on trading rules is a given. If you are still struggling with that, then either (a) your strategy is poor or (b) you are trading too large.

jog on

duc

Do NOT pay attention to the technicals, they are NOT relevant in this market. [They] can only see their formulas and technical analysis - analysis which does not work in these market conditions.

What I am saying is that this market is the virus. Understand the aforementioned effect(s) the virus has on the market and you will understand what the market's going to do in this next wave which is not going to happen, but rather, is already underway.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.