- Joined

- 8 June 2008

- Posts

- 13,700

- Reactions

- 20,415

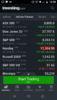

I have to say this happy cat will be happy among the sharks of Wall Street

Looks like the Happy Cat might have been to the vet over the weekend after choking on the Trump "fur ball" Friday pm.

This week's start had to be in doubt. I'm pleased to see this "cat" is ready to "rock n roll".

Straight off the bat, after reviewing the backtest & Share Trade Tracker results I'm expecting the "HappyCat Strategy" to be my very best work so far

$100k Portfolio

When others post backtests reports I've noticed the portfolio size of $100k is often used, so that will be the trading amount of my next live trading endeavour. All I have to do is decide on a strategy to trade.

@Skate how about you trade the happy cat strategy that you have been paper trading a few weeks ago, the dull cat not the shiny cat as it freaks me out as well. It’s only a suggestion as I’ll be happy to follow anything you decide to trade

To confirm, Mr Skate, your stop losses will be triggered manually at the end of each daily session.

You do not keep ready to trigger trader managed SL as discussed in several other threads.

Thanks again for the opportunity

Thanks a lot, just got confused by the specific SL column.my mistakeView attachment 112650

The HappyCat Strategy is a "Weekly Strategy" - I should have made this clearer from the get-go

@qldfrog this is a weekly system with no manual interference. Exits are triggered "after the close" on Friday & the signals are strategy dependant.

Follow the signals without thinking

Following the buy & sell signals consistently will be the key to the profitability of this strategy (even when you are not in agreeance with the signals). The "HappyCat Strategy" will have a habit of selling profitable positions that at times will be hard to stomach. When positions take a breather or run out of steam it's better to follow the system & exit the position & look for another to enter. I'm sure if the signals are followed religiously without additional intervention all will be fine.

Just to confirm

All the signals are generated on Friday after the close. The signals will be entered into Monday pre-auction & reported after the close.

Why after the close

All my research has been conducted under these test condition & if I report them earlier some will make a decision based on that information. When there is the manual intervention I've found it rarely ends well. Trading the pre-auction using the (-/+ 3%) premium takes out the guesswork of trying to time the purchase - even if you have a conditional order placed in the markets you run the risk the position may fail to execute.

Stop Loss

Just to clarify the exit strategy is dependant on a few conditions other than a variable StopLoss which is a safety net. Timing the sell is the "money-making" part of the exercise, selling the position on a Tuesday with "one extra day delay" will make little to no difference.

The exit strategy

The exit is at the heart of the "HappyCat Strategy" as buy signals are a dime-a-dozen.

The heart & soul of the "HappyCat Strategy"

Volatility & momentum is the heart of all breakout systems but the difference with the "HappyCat Strategy" is that it uses both (ATR & ROC) in unison to filter out the false signals.

Skate.

BSE - meets the buy criteriaBSE: IMO the ROC is down from it's recent peak. Price hasn't moved up in the past three weeks so it's unlikely to have been triggered by an ATR indicator. The other candidates have been going up in recent weeks. BSE is the "odd one out".

I'm unaware of your indicator parameters. So if you've checked it. Onward and upward.

A signal is a signalI also thought BSE was the odd one out. But a signal is a signal. It's a maths game, let's play the numbers (they'll work out).

My thoughts had me believe Fridays bar could be the first blue bar again as per your chart for BSE, but not with the greatest conviction.My Ducati Blue Bar Strategy is uncannily accurate in picking the turn of a trend

Peter, as always we truly value your input and thinking. I hope I have credited you for all your valuable information and the willingness to teach others on ASF, I certainly have learned from the sharing of your knowledge and experience many times.Thanks @Skate for the further clarification of the signal in the BSE chart.

I'd like to discuss this "signal" further but I don't wish to create any doubts or indecision in the minds of those following the Happy Cat system.

With that in mind. If I was using this strategy I would not consider the latest signal in the BSE chart as a valid signal. I would modify the coding so that it didn't show up. (*) Even though the entry conditions are still valid (the blue ribbon), there's been no new recent momentum in the price to trigger another entry after the recent trade exit. The recent exit was a trade management exit not a strategy exit. We know that it's the trade management that creates the profitable mathematical edge that we desire. I could classify the recent exit as a reversal of momentum exit. It's not a strategy (trend) exit because we know the trend continues as long as the ribbon remains blue.

(*) My modification: It may be clearer for the system (entries and exits considered together) if any of the trade mgt exits also trigger the ribbon to turn red. If this were the case in this chart there would be no new entry triggered.

I've placed a tick at the last valid (IMO) entry. I've also circled a second chance entry when the strategy (blue ribbon) turned on again. This second chance is only valid if the first entry was not taken (fully invested, asleep at the wheel etc. ).

It's very important to get into price rallies as early as possible.

View attachment 112695

Background

I've previously explained the working of the "HappyCat Strategy" but as a refresher, the strategy uses volatility & momentum to enter & exit positions. There is a multitude of indicators that can help identify the direction, strength, momentum & volatility but the HappyCat uses only two indicators (ROC & ATR) to keep the strategy simple. Typically, the “HappyCat Strategy” analyses momentum & volatility near the top & bottom of a price range helping to identify where to enter & exit a trade. The two indicators even focus on the volatility & momentum during price consolidation & retracements which is a new idea for me.

(*) My modification: It may be clearer for the system (entries and exits considered together) if any of the trade mgt exits also trigger the ribbon to turn red. If this were the case in this chart there would be no new entry triggered.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.