- Joined

- 27 November 2017

- Posts

- 1,200

- Reactions

- 1,887

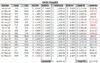

Interesting today is that a sea of red, fln is one of my few green

Who would have thought..one of the reason i actually keep gap up...not found rewarding to eliminate, statiscally in my backtests

Hopefully you are right mate, but you are looking at FLN daily now. If you are on a weekly system then you will need to comment at the end of the week ( same as all of your stocks in that weekly portfolio )