- Joined

- 13 February 2006

- Posts

- 5,408

- Reactions

- 12,588

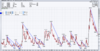

Since we are talking all things $VIX

You'll have to excuse a couple of my lines (could have been more precise). I have also omitted the horizontal lines (resistance/support) entirely because this particular chart is just a short history. You would want a longer time frame to plot the horizontals on.

I use the VIX in combination with other indicators (probably about 4 in all). Mine are obviously not coded (big disadvantage, far more time consuming having to look at stuff) but you can still get there (even if you can't code) and have a pretty good idea what is going on.

Obviously (or maybe not so obvious) you can use the VIX in both directions (as Mr Skate is doing). There is a significant amount of information contained in this (seemingly) simple indicator. Clearly from the posted backtests, the advantage is clear.

So a practical application currently: look to far right of the chart. You will see that the steepness of the blue line is unlikely to be maintained. Any fluctuation now will create a 'break' in the trend line. This will in the current market trigger the 'pullback' that a number of posters have been talking about for the last week. Note also, had horizontal lines been added, the falling VIX would be at +/- the support point and would likely rally, which means falling prices in stocks.

Today, we have a bit of a pullback. Is it a pullback or failing (bounce) trend? It is simply a pull back because the other indicators do not confirm a trend (significant) failure.

But that identifies an important point (that Mr Skate has solved via code): how do you differentiate a 'signal' from noise? This takes some effort and is tricky in isolation. I use other confirmations, but you will have to find something that gells with your style of trading.

jog on

duc

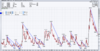

You'll have to excuse a couple of my lines (could have been more precise). I have also omitted the horizontal lines (resistance/support) entirely because this particular chart is just a short history. You would want a longer time frame to plot the horizontals on.

I use the VIX in combination with other indicators (probably about 4 in all). Mine are obviously not coded (big disadvantage, far more time consuming having to look at stuff) but you can still get there (even if you can't code) and have a pretty good idea what is going on.

Obviously (or maybe not so obvious) you can use the VIX in both directions (as Mr Skate is doing). There is a significant amount of information contained in this (seemingly) simple indicator. Clearly from the posted backtests, the advantage is clear.

So a practical application currently: look to far right of the chart. You will see that the steepness of the blue line is unlikely to be maintained. Any fluctuation now will create a 'break' in the trend line. This will in the current market trigger the 'pullback' that a number of posters have been talking about for the last week. Note also, had horizontal lines been added, the falling VIX would be at +/- the support point and would likely rally, which means falling prices in stocks.

Today, we have a bit of a pullback. Is it a pullback or failing (bounce) trend? It is simply a pull back because the other indicators do not confirm a trend (significant) failure.

But that identifies an important point (that Mr Skate has solved via code): how do you differentiate a 'signal' from noise? This takes some effort and is tricky in isolation. I use other confirmations, but you will have to find something that gells with your style of trading.

jog on

duc