- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Well here's one for the books

Oh NO !

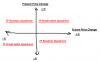

"The Ducati blue bar strategy" has a buy signal today for "SGH" - Slater & Gordon (I nearly fell off my chair) with @Trendnomics words ringing in my ears "you have to become comfortable with something that can be unbearable at times, to avoid emotional tinkering"

I've turned religious

I'm praying that "SGH" doesn't make it to the end of the day as a buy signal. This signal would test my resolve as I'd be shaking in my boots investing even $1 on this dog let alone $15k. Personally I'll be following closely along as this might be the first time "The Ducati blue bar strategy" disappoints. (for the life of me, I can't see how it can't)

Skate.

Oh NO !

"The Ducati blue bar strategy" has a buy signal today for "SGH" - Slater & Gordon (I nearly fell off my chair) with @Trendnomics words ringing in my ears "you have to become comfortable with something that can be unbearable at times, to avoid emotional tinkering"

I've turned religious

I'm praying that "SGH" doesn't make it to the end of the day as a buy signal. This signal would test my resolve as I'd be shaking in my boots investing even $1 on this dog let alone $15k. Personally I'll be following closely along as this might be the first time "The Ducati blue bar strategy" disappoints. (for the life of me, I can't see how it can't)

Skate.