- Joined

- 13 February 2006

- Posts

- 4,994

- Reactions

- 11,213

Since Wordpress have essentially ended their free blog, I'll simply post here. Essentially a daily diary of stuff that I find important, limited to the max. of 12 charts. Sometimes this will be (far) less. On the w/e I kind of wrap up my thoughts (not enough time weekdays due to work commitments).

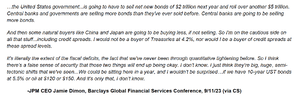

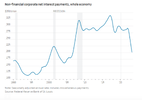

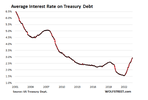

Topping up the TGA creates a loss of liquidity. Due to falling remittances from the Fed (due to ongoing losses on a mark-to-market basis) the Treasury is going to need to sell by year's end a further $2T+ in debt. Taking the public debt to $35T (an increase of $2T in 6 mths +/-).

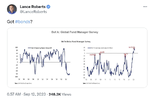

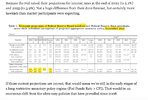

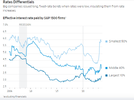

With Fed day tomorrow all eyes will be on Powell to hold rates. That is the significant concensus. If Powell raises against expectations, volatility will ramp up. See fff above: the Fed still is trying to sell to the public that higher rates have a positive effect in lowering inflation. Incorrect. Higher rates increase inflation due to increasing debt service costs. Lowering rates will also increase inflation.

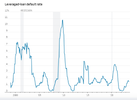

Higher inflation on a secular basis is the most likely outcome. The lower probability outcome is that the Fed allows the Bond market to fail (default en mass).

jog on

duc

Topping up the TGA creates a loss of liquidity. Due to falling remittances from the Fed (due to ongoing losses on a mark-to-market basis) the Treasury is going to need to sell by year's end a further $2T+ in debt. Taking the public debt to $35T (an increase of $2T in 6 mths +/-).

With Fed day tomorrow all eyes will be on Powell to hold rates. That is the significant concensus. If Powell raises against expectations, volatility will ramp up. See fff above: the Fed still is trying to sell to the public that higher rates have a positive effect in lowering inflation. Incorrect. Higher rates increase inflation due to increasing debt service costs. Lowering rates will also increase inflation.

Higher inflation on a secular basis is the most likely outcome. The lower probability outcome is that the Fed allows the Bond market to fail (default en mass).

jog on

duc