- Joined

- 23 November 2004

- Posts

- 3,974

- Reactions

- 850

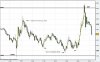

All ords (-23.8) followed the DOW (-63) yesterday.

Overnight the DOW had a green day and rallied in the afternoon to be +22.1 (reaching for 11,000 again).

The ASX looks like it could buck the DOW lead and be in the red today. (SPI down overnight).

Overnight the DOW had a green day and rallied in the afternoon to be +22.1 (reaching for 11,000 again).

The ASX looks like it could buck the DOW lead and be in the red today. (SPI down overnight).