****, ****ty, ****, ****. That was the best way to describe today's trading.

DAX 6 PM - 8:40 PM

Before trading, I decided to check out the world news, commodities, FX etc. The EUR was up against the USD, oil was down (I thought this was irrelevant to the DAX because AFAIK the index isn't composed of any primary resource companies), Obama decided to regulate the banks (I thought this would affect the German banks in the index because of credit flow or something) and most of the markets were in the red. I concluded that the DAX would be following the world's lead and would be heading downwards too, so I entered with a short bias. This was not meant to be. The DAX went up, almost breaking through its high and then fell back down slowly.

Most of my early trades were against the trend and I have no clue what happened halfway in the session, but everything fell apart and it went to ****. Towards the end, frustration and desperation got the better of me, and I tried anything to get a point (I think I was begging at one point lol

. I was almost too embarrassed to post the results.

. I was almost too embarrassed to post the results.

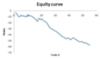

Results

Today's action

Outcome of trades. The first few were against the trend. I thought the DAX was going to plummet but it didn't and my short entries got stopped out.

****

I don't know when I'll be back, but in the mean time, I'm going to "study" what's happening to the DAX whilst it's going sideways. Perhaps it'd help with picking the trend.

DAX 6 PM - 8:40 PM

Before trading, I decided to check out the world news, commodities, FX etc. The EUR was up against the USD, oil was down (I thought this was irrelevant to the DAX because AFAIK the index isn't composed of any primary resource companies), Obama decided to regulate the banks (I thought this would affect the German banks in the index because of credit flow or something) and most of the markets were in the red. I concluded that the DAX would be following the world's lead and would be heading downwards too, so I entered with a short bias. This was not meant to be. The DAX went up, almost breaking through its high and then fell back down slowly.

Most of my early trades were against the trend and I have no clue what happened halfway in the session, but everything fell apart and it went to ****. Towards the end, frustration and desperation got the better of me, and I tried anything to get a point (I think I was begging at one point lol

Results

Today's action

Outcome of trades. The first few were against the trend. I thought the DAX was going to plummet but it didn't and my short entries got stopped out.

****

I don't know when I'll be back, but in the mean time, I'm going to "study" what's happening to the DAX whilst it's going sideways. Perhaps it'd help with picking the trend.