- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,454

Oil News:

US natural gas prices hit a 40-month low last week at just $1.91 per mmBtu as the combined effect of mild weather, strongly rebounding production and sizable inventories continue to weigh on prices.

- February to date, US population-weighted temperature has averaged 46 Fahrenheit, some 5 degrees above normal, whilst nationwide gas production rebounded from the cold snap to an average of 104.4 Bcf per day this month.

- Milder-than-usual weather has also impacted natural gas inventories, with the most recent weekly data showing a meagre withdrawal of just 75 BCf, with current gas stocks 11% above the five-year average.

- Net positioning in the Henry Hub futures contract has been getting shorter for four consecutive weeks, with short positions held by hedge funds and other money managers exceeding long ones by 95,900 lots.

Market Movers

- US oil major ConocoPhillips (NYSE:COP) has emerged as a surprise bidder for Venezuela-owned refiner Citgo Petroleum, submitting a credit bid on the back of its $12 billion worth of asset expropriations in Venezuela.

- Trading major Vitol agreed to buy a controlling stake in Italy’s Saras refinery from the Moratti family, buying 35% of the company for $1.9 billion and outstripping trading rival Trafigura.

- Mining giant Glencore (LON:GLEN) intends to sell its 49% stake in the Koniambo nickel project in New Caledonia, with production at the loss-making asset halted for the next six months.

Tuesday, February 13, 2024

Higher-than-expected US inflation data have capped this week’s pricing upside as the Middle East continues to boil amidst several failed mediation attempts to bring about a ceasefire in the Israel-Palestine conflict. US CPI at 0.3% in January and 3.1% year-on-year does not bode well for interest rate hikes anytime soon and a potential crude inventory increase could start pushing crude prices lower, with Brent so far moving sideways at $82 per barrel.

OPEC Cuts Its Oil Supply Forecast. In its Monthly Oil Market Report, OPEC kept its 2024-2025 demand projection unchanged, however curbed its non-OPEC supply forecast by 150,000 b/d to 70.55 million b/d, citing slower-than-anticipated production growth in the US and Russia.

API Takes White House to Court. The American Petroleum Institute filed a legal challenge to the Biden administration’s plan to limit the 2024-2029 Gulf of Mexico leasing plan to mere three sales (with none in 2024), arguing the White House limits access to energy.

Saudi Arabia Plays Up Energy Transition. Saudi Arabia’s energy minister Abdulaziz bin Salman said that the lowering of Saudi Aramco’s production capacity to 12 million b/d was driven by the need to develop renewable energies, and that its current 3 million b/d spare capacity is enough.

Diamondback to Merge with Endeavor. US shale specialist Diamondback Energy (NASDAQ:FANG) is set to close a deal to buy Endeavor Energy Resources in a $25 billion cash-and-stock transaction, creating the third largest Permian producer at a market cap of $50 billion.

Australia’s Top Oil Producer Doesn’t Give Up. Following its failed attempt to merge with Australian peer Santos (ASX:STO), energy major Woodside (ASX:WDS) said it remains open to acquisitions, rumoured to take a stake in Energy Transfer’s Lake Charles LNG project.

Coal Trading to Become Fashionable Again. The Intercontinental Exchange has drastically cut initial margin requirements for coal derivative contracts by some 40%, with the margin for the API 2 benchmark now down to $11.06 per tonne, boosting its futures contracts’ liquidity.

US Shale Production to Recover in March. The US Energy Information Administration predicts that shale production from the United States’ leading shale basins would increase by 20,000 b/d in March to 9.72 million b/d, almost completely driven by higher Permian output.

Equatorial Guinea In Serious Trouble. Equatorial Guinea’s most promising exploration project, a three-well campaign in Block G, was canceled due to “serious problems” with the project’s drilling rig, announced the same day that ExxonMobil confirmed it would exit the country.

Mexico’s Methane Leaks Continue into 2023. Mexico’s state oil firm Pemex has been releasing large volumes of methane from its Zaap-C offshore platform even after the UN’s Methane Emissions Observatory warned Mexico of the ongoing plumes observed on 25 days last year.

Indian Refiners Eye Atlantic Basin Diversification. India’s Bharat Petroleum Corporation (NSE:BPCL) is looking for oil and gas producing assets in Brazil and West Africa to supply its three refineries in Bina, Mumbai and Kochi, expanding the country’s upstream portfolio.

BP’s Refinery Fire Scares Oil Investors. The blaze at BP’s (NYSE:BP) 440,000 b/d Whiting refinery in Indiana and its slower-than-expected restart scared portfolio investors last week as hedge funds sold a total of 62 million barrels in WTI futures contracts, the fastest rate since October.

Austrian Government Wants to Cut Russian Gas. As the share of Russian gas in Austria’s imports rose to a new record of 98% in December, its energy minister stated that it would consider taking radical steps such as unilaterally ending the country’s supply contract that runs until 2040.

Mozambique’s Giant LNG Project Delayed. Africa’s largest LNG project in development, Mozambique’s 18.1 mtpa Rovuma LNG terminal will only see a final investment decision in 2025, following years of delays caused by ISIS-linked insurgency in the region.

No space for a screenshot of Mr fff:

"The morning action is bullish and I was close to covering my shorts and ending my foray into volatility — until I peered a look at bonds and saw they barely budged.

It’s true — all of the cool stocks are up and my olde man stocks and $TZA/$UVIX positions are tanking lower. But maybe I should give the specter of collapse a chance and let the market absorb all of the buyers to hopefully TRAP THEM long and destroy them!

This is probably delusional thinking on my part and my ego might be getting in the way of proper risk analysis. However, I did just buy 3 cool stocks to hedge my hedges and my losses, although regrettable, are still about than 1%.

If not short, I’d be boasting about the $LYFT numbers and how it meant my $UBER thesis to be correct and also telling you about $BTC and $HOOD — two strategic holdings of mine that I favor.

At any rate, I won’t add to TZA/UVIX and I probably won’t chase the devils going up here. Maybe I’ll just wait an hour or two to see if, perhaps, markets might cave in a little here."

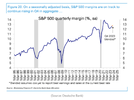

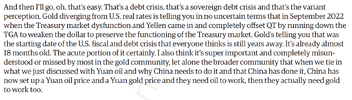

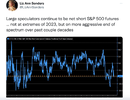

Basically watch the USD.

The USD has not triggered the MOVE index currently. When (if) it does the stock market will swoon badly unless the Fed steps in to add liquidity. Probably lots of it. Of course that is in addition to all the extra liquidity that it is already providing.

I think I saw an article somewhere on ASF about China was looking to weaken Yuan. Incorrect. The Yuan/USD must be stronger Yuan weaker USD.

Everything hinges on a weaker USD and stronger Yuan, Yen, EUR, etc.

jog on

duc

US natural gas prices hit a 40-month low last week at just $1.91 per mmBtu as the combined effect of mild weather, strongly rebounding production and sizable inventories continue to weigh on prices.

- February to date, US population-weighted temperature has averaged 46 Fahrenheit, some 5 degrees above normal, whilst nationwide gas production rebounded from the cold snap to an average of 104.4 Bcf per day this month.

- Milder-than-usual weather has also impacted natural gas inventories, with the most recent weekly data showing a meagre withdrawal of just 75 BCf, with current gas stocks 11% above the five-year average.

- Net positioning in the Henry Hub futures contract has been getting shorter for four consecutive weeks, with short positions held by hedge funds and other money managers exceeding long ones by 95,900 lots.

Market Movers

- US oil major ConocoPhillips (NYSE:COP) has emerged as a surprise bidder for Venezuela-owned refiner Citgo Petroleum, submitting a credit bid on the back of its $12 billion worth of asset expropriations in Venezuela.

- Trading major Vitol agreed to buy a controlling stake in Italy’s Saras refinery from the Moratti family, buying 35% of the company for $1.9 billion and outstripping trading rival Trafigura.

- Mining giant Glencore (LON:GLEN) intends to sell its 49% stake in the Koniambo nickel project in New Caledonia, with production at the loss-making asset halted for the next six months.

Tuesday, February 13, 2024

Higher-than-expected US inflation data have capped this week’s pricing upside as the Middle East continues to boil amidst several failed mediation attempts to bring about a ceasefire in the Israel-Palestine conflict. US CPI at 0.3% in January and 3.1% year-on-year does not bode well for interest rate hikes anytime soon and a potential crude inventory increase could start pushing crude prices lower, with Brent so far moving sideways at $82 per barrel.

OPEC Cuts Its Oil Supply Forecast. In its Monthly Oil Market Report, OPEC kept its 2024-2025 demand projection unchanged, however curbed its non-OPEC supply forecast by 150,000 b/d to 70.55 million b/d, citing slower-than-anticipated production growth in the US and Russia.

API Takes White House to Court. The American Petroleum Institute filed a legal challenge to the Biden administration’s plan to limit the 2024-2029 Gulf of Mexico leasing plan to mere three sales (with none in 2024), arguing the White House limits access to energy.

Saudi Arabia Plays Up Energy Transition. Saudi Arabia’s energy minister Abdulaziz bin Salman said that the lowering of Saudi Aramco’s production capacity to 12 million b/d was driven by the need to develop renewable energies, and that its current 3 million b/d spare capacity is enough.

Diamondback to Merge with Endeavor. US shale specialist Diamondback Energy (NASDAQ:FANG) is set to close a deal to buy Endeavor Energy Resources in a $25 billion cash-and-stock transaction, creating the third largest Permian producer at a market cap of $50 billion.

Australia’s Top Oil Producer Doesn’t Give Up. Following its failed attempt to merge with Australian peer Santos (ASX:STO), energy major Woodside (ASX:WDS) said it remains open to acquisitions, rumoured to take a stake in Energy Transfer’s Lake Charles LNG project.

Coal Trading to Become Fashionable Again. The Intercontinental Exchange has drastically cut initial margin requirements for coal derivative contracts by some 40%, with the margin for the API 2 benchmark now down to $11.06 per tonne, boosting its futures contracts’ liquidity.

US Shale Production to Recover in March. The US Energy Information Administration predicts that shale production from the United States’ leading shale basins would increase by 20,000 b/d in March to 9.72 million b/d, almost completely driven by higher Permian output.

Equatorial Guinea In Serious Trouble. Equatorial Guinea’s most promising exploration project, a three-well campaign in Block G, was canceled due to “serious problems” with the project’s drilling rig, announced the same day that ExxonMobil confirmed it would exit the country.

Mexico’s Methane Leaks Continue into 2023. Mexico’s state oil firm Pemex has been releasing large volumes of methane from its Zaap-C offshore platform even after the UN’s Methane Emissions Observatory warned Mexico of the ongoing plumes observed on 25 days last year.

Indian Refiners Eye Atlantic Basin Diversification. India’s Bharat Petroleum Corporation (NSE:BPCL) is looking for oil and gas producing assets in Brazil and West Africa to supply its three refineries in Bina, Mumbai and Kochi, expanding the country’s upstream portfolio.

BP’s Refinery Fire Scares Oil Investors. The blaze at BP’s (NYSE:BP) 440,000 b/d Whiting refinery in Indiana and its slower-than-expected restart scared portfolio investors last week as hedge funds sold a total of 62 million barrels in WTI futures contracts, the fastest rate since October.

Austrian Government Wants to Cut Russian Gas. As the share of Russian gas in Austria’s imports rose to a new record of 98% in December, its energy minister stated that it would consider taking radical steps such as unilaterally ending the country’s supply contract that runs until 2040.

Mozambique’s Giant LNG Project Delayed. Africa’s largest LNG project in development, Mozambique’s 18.1 mtpa Rovuma LNG terminal will only see a final investment decision in 2025, following years of delays caused by ISIS-linked insurgency in the region.

No space for a screenshot of Mr fff:

"The morning action is bullish and I was close to covering my shorts and ending my foray into volatility — until I peered a look at bonds and saw they barely budged.

It’s true — all of the cool stocks are up and my olde man stocks and $TZA/$UVIX positions are tanking lower. But maybe I should give the specter of collapse a chance and let the market absorb all of the buyers to hopefully TRAP THEM long and destroy them!

This is probably delusional thinking on my part and my ego might be getting in the way of proper risk analysis. However, I did just buy 3 cool stocks to hedge my hedges and my losses, although regrettable, are still about than 1%.

If not short, I’d be boasting about the $LYFT numbers and how it meant my $UBER thesis to be correct and also telling you about $BTC and $HOOD — two strategic holdings of mine that I favor.

At any rate, I won’t add to TZA/UVIX and I probably won’t chase the devils going up here. Maybe I’ll just wait an hour or two to see if, perhaps, markets might cave in a little here."

Basically watch the USD.

The USD has not triggered the MOVE index currently. When (if) it does the stock market will swoon badly unless the Fed steps in to add liquidity. Probably lots of it. Of course that is in addition to all the extra liquidity that it is already providing.

I think I saw an article somewhere on ASF about China was looking to weaken Yuan. Incorrect. The Yuan/USD must be stronger Yuan weaker USD.

Everything hinges on a weaker USD and stronger Yuan, Yen, EUR, etc.

jog on

duc