- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

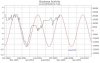

For those interested in Cycles Analsysis, last year in October I posted a chart with a forecast for the DJI based on Cycles Analysis by The Foundation For the Study Of Cycles based on FFT.

This called for a significant decline in the months ahead and has followed the forecast pretty much to script. I have attached this chart again(1st chart) for those interested. I should note that this information went pretty much unnoticed on this forum at the time, which to some extent IMO actually added more weight to the forecast due to extreme bullish sentiment.

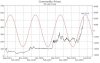

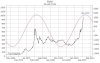

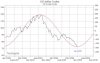

The Foundation has now released further forecasts covering a whole host of markets ranging from commodities, USD, Gold, DJI to name and few I have attached them for those interested.

As mentioned back then this is not exact timing but rather medium to longer term forecasts. Furthermore these projections also show confluence to the EW patterns that I have seen in the last few months as well as my own Cycles Analysis strategy(which differs from the one used in the charts attached), especially in the case of Gold and the USD which IMO have both been in topping and bottoming patterns.

Of course there is no certainty in market forecasts, but these charts maybe a shock to the expectations of some.

Regards

Wavepicker

This called for a significant decline in the months ahead and has followed the forecast pretty much to script. I have attached this chart again(1st chart) for those interested. I should note that this information went pretty much unnoticed on this forum at the time, which to some extent IMO actually added more weight to the forecast due to extreme bullish sentiment.

The Foundation has now released further forecasts covering a whole host of markets ranging from commodities, USD, Gold, DJI to name and few I have attached them for those interested.

As mentioned back then this is not exact timing but rather medium to longer term forecasts. Furthermore these projections also show confluence to the EW patterns that I have seen in the last few months as well as my own Cycles Analysis strategy(which differs from the one used in the charts attached), especially in the case of Gold and the USD which IMO have both been in topping and bottoming patterns.

Of course there is no certainty in market forecasts, but these charts maybe a shock to the expectations of some.

Regards

Wavepicker