You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CVN - Carnarvon Energy

- Thread starter yogi-in-oz

- Start date

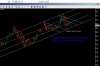

Good to see different views on charts. Heres my daily chart from Sep 07 also.

Almost all trading is within the 3 trend channels bar a shortrise above line 4 around 12/11/07. Fell quite heavily from there but found support at longterm uptrend (line 1) and recovered. For the past 2 weeks CVN has been trading in the middle trend channel. As you can see quite a few times line 2 provided support. Todays close is just about line 3. Will be interesting to see if it will provide support and for trading to continue in the 3rd channel.

Interested to hear other opinions/thoughts chartwise.

Regards

Continuing on from johnnyg's chart which showed CVN trading within 3 channels, we have subsequently seen the SP climb to the top of the channels at line 4 and predictably retrace.

If all goes to plan and the SP continues in this pattern (of course it won't now that I've said that...) we should see another down day Monday with a bit of a blowoff downwards to 60c, then hopefully followed by a rebound as buyers re-emerge.

We'll be expecting news Monday night re WB-1 deep testing results and this has perhaps even bigger potential than the last well so I would expect people to be taking positions in anticipation by Monday pm.

Here's a chart with my prediction for Monday drawn in place. A bit hard to see but basically I'm thinking an open around 65, a low around 61 and a close around 63. Also possibility of a close higher than open based on WB-1 buyers, but either way I'm thinking the bottom will be in by mid morning Monday.

Attachments

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,714

- Reactions

- 10,361

Continuing on from johnnyg's chart which showed CVN trading within 3 channels, we have subsequently seen the SP climb to the top of the channels at line 4 and predictably retrace.

If all goes to plan and the SP continues in this pattern (of course it won't now that I've said that...) we should see another down day Monday with a bit of a blowoff downwards to 60c, then hopefully followed by a rebound as buyers re-emerge.

We'll be expecting news Monday night re WB-1 deep testing results and this has perhaps even bigger potential than the last well so I would expect people to be taking positions in anticipation by Monday pm.

Here's a chart with my prediction for Monday drawn in place. A bit hard to see but basically I'm thinking an open around 65, a low around 61 and a close around 63. Also possibility of a close higher than open based on WB-1 buyers, but either way I'm thinking the bottom will be in by mid morning Monday.

I agree, predictions are difficult aren't they. It would fit in with recent price and volume action, and those channels.

gg

We'll be expecting news Monday night re WB-1 deep testing results

CALGARY, ALBERTA--(Marketwire - Jan. 2, 2008) -

"Testing is anticipated to be completed within the next 12 days, initiating in 5 days after the Aztec 14 rig has been moved off location."

Ill be expecting news more to the end of the months as testing will start 5 days after Aztec 14 rig has been moved off location.

I'll be watching POE closely on www.tsx.com

This tread has become a bit wishy washy as people have jumped on board. The "originals" who were very informative no longer post.

DYOR

Good Bye for now

Well Rob17, to me that sounds like testing is anticipated to be completed within the next 12 days.CALGARY, ALBERTA--(Marketwire - Jan. 2, 2008) -

"Testing is anticipated to be completed within the next 12 days..."

So from Jan 2 that would mean by Jan 14 which is Monday.

It may be late a day or 2 like the last well but it shouldn't be too far off from Monday.

This tread has become a bit wishy washy as people have jumped on board. The "originals" who were very informative no longer post.

I was just killing a bit of time between ann's, following up on a prior post regarding the trading patterns.

Hopefully some may find it interesting enough to read and comment on. I think we all know about the fundamentals by now, but to me the chart trading pattern is interesting at the moment.

I've been holding since August and have accumulated a lot of them now.

I tried a short term trade with some of them once and got it wrong so decided to just keep buying the dips when I could. Thankfully CVN have kept on succeeding so the SP has kept trending up, albeit with a lot of volatility.

I'm happy to continue holding and will look to add more tomorrow.

Good luck to all.

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Riles, here is update on my chart, with both short term downtrend lines taken from similar retraces in previous months, marked as 1 & 2. I placed these on after the spike to the top trendline. May have to place a buy in tomorrow.

Regards.

Regards.

Attachments

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Wrongun it read - Looking for a re-entry around 0.66 which is a .786 fib retracement. Possible entry @ 0.62 with a 1.0 retrace on fib, however not likely, will keep a close eye on the dow to see how it affects CVN.

Hands up who the lucky buggers were who got some @ 0.61 this morning? Dam having a day job LOL, but i brought back in at mid-day.

Hands up who the lucky buggers were who got some @ 0.61 this morning? Dam having a day job LOL, but i brought back in at mid-day.

I missed out too Johnnyg!

Had a visitor over and missed the 2 drops this morning - after all that analysis too lol!

Shoulda had a buy order in place, had to pay 65c. Still confident that this was a good entry.

WB-1 sounds promising - all that lost circulation into such a large reservoir - could be huge.

Had a visitor over and missed the 2 drops this morning - after all that analysis too lol!

Shoulda had a buy order in place, had to pay 65c. Still confident that this was a good entry.

WB-1 sounds promising - all that lost circulation into such a large reservoir - could be huge.

Especially when they stopped drilling at like 79 metres of the 220 metre thick zone (or something to that effect).

Has anyone got any updated Hartley's reports concerning CVN? I remember someone saying $1.23 and if this well is good $1.53 or something? Not too sure though!

And how does everyone feel about CVN standing up in '08? With overall market sentiment down can CVN find some new players to push it to the stratosphere?

Has anyone got any updated Hartley's reports concerning CVN? I remember someone saying $1.23 and if this well is good $1.53 or something? Not too sure though!

And how does everyone feel about CVN standing up in '08? With overall market sentiment down can CVN find some new players to push it to the stratosphere?

The latest broker report I know of is the Hartleys Dec one on Carnarvon's website.

This was prior to the L44h-d1 flow rates so was done when the JV was at 6,000bopd.

Some snippets following: Note this WB-1 deep target we're waiting on now is not a low flow rate sandstone play, but a fractured volcanic like those found in NSE.

Valuation Increased to 89cps - We have updated our valuation of CVN based on full development of the Na Sanun East field. Further exploration success in other fields such as Wichian Buri, Bo Rang, Si Thep and offshore WA could deliver additional upside to our valuation.

Wichian Buri and Si Thep are sandstone plays that have been producing for some 20 years; however, individual wells generally produce at a very low flow rate. Na Sanun and Na Sanun East contain the same sandstone plays, but are most significant because of the discovery of additional oil bearing formations in a relatively new play type pertaining to volcanic structures. These reservoirs typically produce at significantly higher flow rates than the Wichian Buri and Si Thep fields.

Whilst the production license is being processed, a slowdown in field appraisal and development at Na Sanun

East is anticipated in January to allow field teams a break from the recent hectic schedule. There will still be

plenty of activity however in relation to the drilling of prospects in other fields and appraisal of the as yet

untested volcanic zones in Na Sanun East that have showed encouraging signs.

An historic well, Wichian Buri 1, encountered fractured volcanics at depth but was never tested due to the lack of understanding of this type of reservoir. This prospect will be retested by Carnarvon. Success at Wichian Buri and Si Thep, in particular, could yield immediate pay off as existing infrastructure could be utilised.

Other possible activities include the shutting in of wells such as POE-9 to test the other volcanic zones that have

been intersected. This would not affect sales in the short term as the 6000 bopd limit imposed by infrastructure

constraints would be fully utilised even with one or more wells shut in.

Reserves Value

The 21mmbbls gross reserves expected equates to 10mmbbls net to Carnarvon and at $21 NPV/boe gives a

conservative valuation of 36cps.

With the addition of Wichian Buri reserves of 2.8mmbbls @ $19 NPV/boe giving a valuation of 9cps, the share

price is underpinned at 45c. We believe that resource estimates (gross) are more likely in the range 40mmbbls

(80% probability) to 100mmbbls (10% probability) – putting the value in the range $0.49 to $1.32 for Na Sanun

East alone.

This was prior to the L44h-d1 flow rates so was done when the JV was at 6,000bopd.

Some snippets following: Note this WB-1 deep target we're waiting on now is not a low flow rate sandstone play, but a fractured volcanic like those found in NSE.

Valuation Increased to 89cps - We have updated our valuation of CVN based on full development of the Na Sanun East field. Further exploration success in other fields such as Wichian Buri, Bo Rang, Si Thep and offshore WA could deliver additional upside to our valuation.

Wichian Buri and Si Thep are sandstone plays that have been producing for some 20 years; however, individual wells generally produce at a very low flow rate. Na Sanun and Na Sanun East contain the same sandstone plays, but are most significant because of the discovery of additional oil bearing formations in a relatively new play type pertaining to volcanic structures. These reservoirs typically produce at significantly higher flow rates than the Wichian Buri and Si Thep fields.

Whilst the production license is being processed, a slowdown in field appraisal and development at Na Sanun

East is anticipated in January to allow field teams a break from the recent hectic schedule. There will still be

plenty of activity however in relation to the drilling of prospects in other fields and appraisal of the as yet

untested volcanic zones in Na Sanun East that have showed encouraging signs.

An historic well, Wichian Buri 1, encountered fractured volcanics at depth but was never tested due to the lack of understanding of this type of reservoir. This prospect will be retested by Carnarvon. Success at Wichian Buri and Si Thep, in particular, could yield immediate pay off as existing infrastructure could be utilised.

Other possible activities include the shutting in of wells such as POE-9 to test the other volcanic zones that have

been intersected. This would not affect sales in the short term as the 6000 bopd limit imposed by infrastructure

constraints would be fully utilised even with one or more wells shut in.

Reserves Value

The 21mmbbls gross reserves expected equates to 10mmbbls net to Carnarvon and at $21 NPV/boe gives a

conservative valuation of 36cps.

With the addition of Wichian Buri reserves of 2.8mmbbls @ $19 NPV/boe giving a valuation of 9cps, the share

price is underpinned at 45c. We believe that resource estimates (gross) are more likely in the range 40mmbbls

(80% probability) to 100mmbbls (10% probability) – putting the value in the range $0.49 to $1.32 for Na Sanun

East alone.

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

I missed out too Johnnyg!

Had a visitor over and missed the 2 drops this morning - after all that analysis too lol!

Shoulda had a buy order in place, had to pay 65c. Still confident that this was a good entry.

WB-1 sounds promising - all that lost circulation into such a large reservoir - could be huge.

LOL true, my only worry with a buy order in at say 0.61-0.62 and being away from the screen would be that if it broke the bottom longterm uptrend (which it did just briefly today) kept falling you could come home and find youself in abit of trouble. Id rather pay a few cents more (in @ 0.645) and see the SP find support and bounce before entering. (which it did today)

Todays candle could signify a trend reversal. Which I think may be confirmed by tomorrows trading.

Regards

Especially when they stopped drilling at like 79 metres of the 220 metre thick zone (or something to that effect).

Has anyone got any updated Hartley's reports concerning CVN? I remember someone saying $1.23 and if this well is good $1.53 or something? Not too sure though!

And how does everyone feel about CVN standing up in '08? With overall market sentiment down can CVN find some new players to push it to the stratosphere?

There was an update but not a full report from Hartley. I can confirm the new price target is 1.23 (beginning of january)

- Joined

- 23 October 2007

- Posts

- 12

- Reactions

- 0

Does anyone know what time the announcements usually pop up on marketwire for POE? Hoping might catch some news tonight on latest drill for CVN.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,714

- Reactions

- 10,361

Does anyone know what time the announcements usually pop up on marketwire for POE? Hoping might catch some news tonight on latest drill for CVN.

Looking at the recent bars on this chart I do not think that there will be any news of note out of Thailand tonight.

Usually the rickshaw is ahead of the noodles on well reports

Volume and price either go up or down on the ASX during the day, prior to the announcement.

Todays volume is low and the price is indecisive. The price opened and closed just up slightly, with a range up and down not showing much appetite for buying or selling.

gg

Attachments

- Joined

- 23 October 2007

- Posts

- 12

- Reactions

- 0

"Usually the rickshaw is ahead of the noodles on well reports" haha like that one garpal! yeh I was thinking the same thing looking at the volume and movement today, but was hoping...

does anyone know what time the announcements usually pop up on marketwire for POE? Hopeing might catch some news tonight on latest drill for CVN

I am in contact with the analyst who make the coverage on CVN and he told me that the report will be due this week.

Be patient

- Joined

- 23 October 2007

- Posts

- 12

- Reactions

- 0

yeh patience was never a good virtue of mine, just like waiting for santa at chrissy and to think 34 more christmas eve's this yr to go awaiting santa's drilling results

- Joined

- 23 October 2007

- Posts

- 12

- Reactions

- 0

UPDATE IN BUT NOT AS HOPED ALTHOUGH GOOD TO SEE LOGISTICS BEING SORTED OUT...

Pan Orient Energy Corp.: Thailand Operations Update

CALGARY, ALBERTA--(Marketwire - Jan. 15, 2008) - Pan Orient Energy Corp. (TSX VENTURE OE) -

OE) -

NOT FOR DISSEMINATION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

WICHIAN BURI-1 "DEEP" (60% WI & Operator)

The WB-1 (Deep) exploration well has been abandoned after testing small amounts of natural gas with approximately 750 barrels of water per day from an open hole volcanic interval between approximately 1,500 to 1,590 meters. A second, shallower, 10m thick volcanic at approximately 1,200 meters that had oil shows, but no lost circulation while drilling, was perforated and found tight. WB-1 (Deep) will be completed as a future water disposal well.

In the latter half of 2008 the Company plans to drill Wichian Buri F sandstone development wells north of WB-1 (Deep) and will once again target the same potential volcanic reservoirs in a much structurally higher position.

L44-R Exploration Well (60% WI & Operator)

The moderate risk, high impact L44-R exploration well is located approximately 10.5 kms south of the producing NSE oilfield and within the main volcanic reservoir play fairway, is anticipated to start drilling in 5 days. The well is targeting an approximately 7 square km structural closure with multiple potential volcanic reservoir targets between 800 to 1,300 meters. Drilling is anticipated to take 17-24 days.

Production Update

Further to the December 12, 2007, news release, production has grown as anticipated and is currently approximately 7,350 bopd gross (4,410 bopd net to Pan Orient) with a current fleet of 41 tankers transporting the oil to the Bangkok refinery. Six additional tankers are anticipated to become available shortly, which will increase production to approximately 8,450 bopd gross (5,070 bopd net) and further tanker capacity has been arranged which will permit production to increase to the current field production capacity, from existing wells, of approximately 10,000 bopd gross (6,000 bopd net) by late February to early March.

Pan Orient Energy Corp.: Thailand Operations Update

CALGARY, ALBERTA--(Marketwire - Jan. 15, 2008) - Pan Orient Energy Corp. (TSX VENTURE

NOT FOR DISSEMINATION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

WICHIAN BURI-1 "DEEP" (60% WI & Operator)

The WB-1 (Deep) exploration well has been abandoned after testing small amounts of natural gas with approximately 750 barrels of water per day from an open hole volcanic interval between approximately 1,500 to 1,590 meters. A second, shallower, 10m thick volcanic at approximately 1,200 meters that had oil shows, but no lost circulation while drilling, was perforated and found tight. WB-1 (Deep) will be completed as a future water disposal well.

In the latter half of 2008 the Company plans to drill Wichian Buri F sandstone development wells north of WB-1 (Deep) and will once again target the same potential volcanic reservoirs in a much structurally higher position.

L44-R Exploration Well (60% WI & Operator)

The moderate risk, high impact L44-R exploration well is located approximately 10.5 kms south of the producing NSE oilfield and within the main volcanic reservoir play fairway, is anticipated to start drilling in 5 days. The well is targeting an approximately 7 square km structural closure with multiple potential volcanic reservoir targets between 800 to 1,300 meters. Drilling is anticipated to take 17-24 days.

Production Update

Further to the December 12, 2007, news release, production has grown as anticipated and is currently approximately 7,350 bopd gross (4,410 bopd net to Pan Orient) with a current fleet of 41 tankers transporting the oil to the Bangkok refinery. Six additional tankers are anticipated to become available shortly, which will increase production to approximately 8,450 bopd gross (5,070 bopd net) and further tanker capacity has been arranged which will permit production to increase to the current field production capacity, from existing wells, of approximately 10,000 bopd gross (6,000 bopd net) by late February to early March.

Bummer. Was getting used to good oil flows with every new well! Was particularly hoping they could open up this new field with a good success first up but not this time unfortunately.

Still all's not lost with WB yet as they will try again further afield later this year.

Good to see they are getting more tankers and seem to have resolved the transport bottleneck.

Expect some downward pressure on the SP, but as I see it they should be over 70c based on the previous ann which added 4000bopd. Any selloff will create yet another buying opportunity IMO.

Still all's not lost with WB yet as they will try again further afield later this year.

Good to see they are getting more tankers and seem to have resolved the transport bottleneck.

Expect some downward pressure on the SP, but as I see it they should be over 70c based on the previous ann which added 4000bopd. Any selloff will create yet another buying opportunity IMO.