China Bears

- Thread starter Mr Z

- Start date

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

Many years ago, Soros predicted China would be strong until 2015. So I'm happy to go along with that for the moment, unless anyone knows of a more recent comment made by him??

Near term bullish, long term bearish for me.

Near term bullish, long term bearish for me.

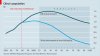

The one child policy...

...is being touted as a demographic wall which will slow China, aging population and all that. Some say it is due to hit in six years or so, maybe that informs Soro's idea. The year that it becomes important seems to be a little rubbery due to that fact that the policy has not been strictly implemented. No one is really sure when it starts to become an issue.

China’s Population: A Looming Demographic Time Bomb

George Shultz, Former US Secretary of State - On China

...is being touted as a demographic wall which will slow China, aging population and all that. Some say it is due to hit in six years or so, maybe that informs Soro's idea. The year that it becomes important seems to be a little rubbery due to that fact that the policy has not been strictly implemented. No one is really sure when it starts to become an issue.

China’s Population: A Looming Demographic Time Bomb

George Shultz, Former US Secretary of State - On China

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,120

- Reactions

- 13,591

I wouldn't like to put "terms" on it (given up on that

), but surely there has to be a hiccup or two along the way, even if the long term view is bullish?

), but surely there has to be a hiccup or two along the way, even if the long term view is bullish?

- Joined

- 16 April 2007

- Posts

- 926

- Reactions

- 1

don't discount the likelihood of war. china is becoming increasingly aggressive, and it engages in endless acts of espionage and an undeclared but highly active cyber war against EVERYONE. they may just piss someone off enough to get slapped hard for it, we all saw how amazing stuxnet was.

then theres conventional military flashpoints like the south china sea and taiwan. even if the war between the US and china stays cold, it could still bury china like it did the soviet union.

then there's all sorts of internal pressures mounting in china. there are endless riots going on in regional cities which are unreported due to media blackouts, and hundreds of millions of peasants looking to upgrade their quality of life which the world probably can't afford. there's endemic corruption, severe environmental degradation and dependence upon external energy and resource sources which can be easily disrupted.

from an isolated and purely economic point of view i'm short term bear, long term bull, but the world doesn't work like that and i think the likelihood of conflict between china and the west, or even china vs itself, is quite high.

then theres conventional military flashpoints like the south china sea and taiwan. even if the war between the US and china stays cold, it could still bury china like it did the soviet union.

then there's all sorts of internal pressures mounting in china. there are endless riots going on in regional cities which are unreported due to media blackouts, and hundreds of millions of peasants looking to upgrade their quality of life which the world probably can't afford. there's endemic corruption, severe environmental degradation and dependence upon external energy and resource sources which can be easily disrupted.

from an isolated and purely economic point of view i'm short term bear, long term bull, but the world doesn't work like that and i think the likelihood of conflict between china and the west, or even china vs itself, is quite high.

I would think that an economic event would come first, these things tend to flow that way. Booms bust then comes trade war then comes a hot war. The trade angst seems to be hotting with the US. Anyway, yes a real possible in the longer run but to me it doesn't feel like we are close yet.

- Joined

- 16 April 2007

- Posts

- 926

- Reactions

- 1

Booms bust then comes trade war then comes a hot war. The trade angst seems to be hotting with the US.

funny you should mention that

BEIJING, Oct. 13 (Xinhuanet) -- Arguing that the RMB yuan's exchange rate is not the cause of China- U.S. trade imbalance, China expressed its strong oppositions hours after the U.S. Senate passed a controversial bill that would slap tariffs on Chinese goods for the so-called "currency manipulation", warning the U.S. politicians against politicizing the issue of China's currency and resorting to trade protectionism.

In a written statement posted on its website, China's Foreign Ministry urged rejection of the bill.

"This proposed bill in the name of so-called 'exchange rate misalignment' is protectionism and a serious violation of World Trade Organization rules," Ma Zhaoxu, a Foreign Ministry spokesperson, said in the statement. "This won't solve America's own economic and employment problems."

China's Vice Foreign Minister Cui Tiankai on Monday warned that the bill could trigger a trade war and hold back global economic recovery, and it might have an adverse impact on the development of the relations between the two countries.

"Should the proposed legislation become law, the only result would be a trade war between China and the US and that would be a lose-lose situation for both sides," Cui said.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,228

don't discount the likelihood of war. china is becoming increasingly aggressive, and it engages in endless acts of espionage and an undeclared but highly active cyber war against EVERYONE. they may just piss someone off enough to get slapped hard for it, we all saw how amazing stuxnet was.

then theres conventional military flashpoints like the south china sea and taiwan. even if the war between the US and china stays cold, it could still bury china like it did the soviet union.

then there's all sorts of internal pressures mounting in china. there are endless riots going on in regional cities which are unreported due to media blackouts, and hundreds of millions of peasants looking to upgrade their quality of life which the world probably can't afford. there's endemic corruption, severe environmental degradation and dependence upon external energy and resource sources which can be easily disrupted.

from an isolated and purely economic point of view i'm short term bear, long term bull, but the world doesn't work like that and i think the likelihood of conflict between china and the west, or even china vs itself, is quite high.

The truth has been kept from the peasants for as long time. The truth being that the incredible wealth enjoyed by the upper and upper-middle classes has come largely through exploitation of the uneducated lower classes. American corporations are largely to blame for showing the locals how to run sweatshops and generate huge profits this way.

I'm assuming the 'authorities' would want to be pro-active and start looking after the uneducated masses before they learn to read and use a computer. Implementing changes such as award wages, work injury insurance, paid leave, health care and so on should be high on their list you'd imagine. Otherwise, civil unrest. The government's mantra "everyone CAN be rich" is bull****. It's a lie they tell the workers to keep them working hard.

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

China is a bully and a coward.

They will only make war when they know they have overwhelming power that others are powerless against. Once they have a nation they use the population as slaves and flood them out with their own people they are terrifyingly brutal and cruel to the people of the nations they occupy.

China attacks and occupies small nations around them who can do nothing against them. They choose times when the West is tied up with bigger matters like Vietnam etc.

A hot war is unlikely with China as they know they do not have the power yet.

Don't discount their covert armies all over the world that we regard as students and immigrants. Not to mention North Korea.

If any one saw ABCs story on the Chinese sex slave syndicates it gives you an idea of what is normal for powerful Chinese. We see this as unthinkable, horrific and extreme. For them it's busness!! They have not sense of human rights.

http://www.smh.com.au/national/legal-brothels-linked-to-international-sex-trafficking-rings-20111009-1lfxs.html

Given all that it's hard to see how China can ultimately succeed in the long run. It runs against human nature which prospers in free, peaceful and democratic environments.

They will only make war when they know they have overwhelming power that others are powerless against. Once they have a nation they use the population as slaves and flood them out with their own people they are terrifyingly brutal and cruel to the people of the nations they occupy.

China attacks and occupies small nations around them who can do nothing against them. They choose times when the West is tied up with bigger matters like Vietnam etc.

A hot war is unlikely with China as they know they do not have the power yet.

Don't discount their covert armies all over the world that we regard as students and immigrants. Not to mention North Korea.

If any one saw ABCs story on the Chinese sex slave syndicates it gives you an idea of what is normal for powerful Chinese. We see this as unthinkable, horrific and extreme. For them it's busness!! They have not sense of human rights.

http://www.smh.com.au/national/legal-brothels-linked-to-international-sex-trafficking-rings-20111009-1lfxs.html

Given all that it's hard to see how China can ultimately succeed in the long run. It runs against human nature which prospers in free, peaceful and democratic environments.

Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 10,185

- Reactions

- 7,487

Re: China Pandas

Everyone knows the Chinese bear is a Panda. So the heading should be changed :

:

Everyone knows the Chinese bear is a Panda. So the heading should be changed

- Joined

- 20 May 2011

- Posts

- 1,544

- Reactions

- 1

Too many economic problems, too much of a housing bubble. The question is, how long can they keep it going for.

Glen48

Money can't buy Poverty

- Joined

- 4 September 2008

- Posts

- 2,444

- Reactions

- 4

Saw a report were they estimate there are 55 million empty units and still building, one expert went around during a eclipse looking for office lights and there weren't many on, the local government's are using black market money to expand and no Mayor wants to report Chairman Who Flung Dung he is deep in debt.

So the reals story sounds as bad or worse than USA RE market which is still falling.

When USA RE gets to buy one take one its time to get out the bullets and beans.

So the reals story sounds as bad or worse than USA RE market which is still falling.

When USA RE gets to buy one take one its time to get out the bullets and beans.

too much of a housing bubble.

The housing situation is odd, I am not sure I'd call it a bubble, but I'm not sure what it is!? 60% of houses are bought with cash and the ownership of second and third places is limited by restrictive financing options. Yet on the build out side the production seems very optimistic. It is just nothing like what the US has seen and what exists here in Australia. The Chinese still have many options to shore up housing on the demand side of the equation... but will they and will it work? ---> It is not your garden variety bubble if it is one!

Saw a report were they estimate there are 55 million empty units and still building, one expert went around during a eclipse looking for office lights and there weren't many on, the local government's are using black market money to expand and no Mayor wants to report Chairman Who Flung Dung he is deep in debt.

So the reals story sounds as bad or worse than USA RE market which is still falling.

When USA RE gets to buy one take one its time to get out the bullets and beans.

But you see the difference? It is credit driven over supply against choked back demand. Not your typical bubble dynamic, in fact it strikes me that this imbalance will resolve much faster than a US style bubble.

- Joined

- 20 May 2011

- Posts

- 1,544

- Reactions

- 1

The housing situation is odd, I am not sure I'd call it a bubble, but I'm not sure what it is!? 60% of houses are bought with cash and the ownership of second and third places is limited by restrictive financing options. Yet on the build out side the production seems very optimistic. It is just nothing like what the US has seen and what exists here in Australia. The Chinese still have many options to shore up housing demand side of the equation... but will they and will it work? ---> It is not your garden variety bubble if it is one!

Call it a malinvestment if you will, it is probably the most accurate term.

The apartments constructed are not adequate to meet demand, as they are too expensive. A lot of buildings constructed are of poor quality and fall apart quickly.

Housing is used as a store of wealth in China, as there are no alternative inflation beating investments. People speculate on property, believing it can only go up. That is in my view the very definition of a bubble.

Call it a malinvestment if you will, it is probably the most accurate term.

The apartments constructed are not adequate to meet demand, as they are too expensive. A lot of buildings constructed are of poor quality and fall apart quickly.

Housing is used as a store of wealth in China, as there are no alternative inflation beating investments. People speculate on property, believing it can only go up. That is in my view the very definition of a bubble.

Perhaps malinvestment but China certainly has the population to use them.

If 60% are paid for in Cash and financing is restricted it is hard to argue that they are too expensive given western norms.

I would not comment on quality until I had seen them, US commentators seem to love running down Chinese capability. I'm sure they are rough and ready but I think falling apart is probably a stretch, the Chinese are not stupid.

Leveraged supply meets leveraged demand with speculative activity on both sides of the equation = bubble. This is not what you call a classic bubble.

- Joined

- 16 April 2007

- Posts

- 926

- Reactions

- 1

I would not comment on quality until I had seen them, US commentators seem to love running down Chinese capability. I'm sure they are rough and ready but I think falling apart is probably a stretch, the Chinese are not stupid.

no, but many are greedy and they don't have the regulation or procedures we do.

Attachments

Similar threads

- Replies

- 8

- Views

- 801