JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,289

- Reactions

- 6,352

A few years old but still a lot of good information here - PAYMENT COSTS IN AUSTRALIA

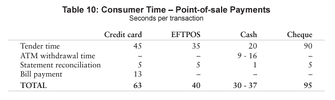

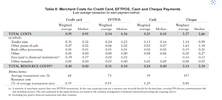

The main resource cost directly incurred by consumers is the cost of their time to make payments. Consumers also incur charges by financial institutions (and in some cases merchants) for payment services.... Of these various time costs, the easiest to measure is tender time – the time spent at the check-out while the payment is being processed. The estimates below draw on the tender times discussed in Section 4.1, which showed that the fastest processing times are for cash payments, followed by EFTPOS, credit cards and cheques.

Resource link - https://www.rba.gov.au/payments-and.../paymts-sys-rev-conf/2007/7-payment-costs.pdf

2. Measuring Costs

2.1 Cost concepts

Measuring the costs associated with making payments is far from straightforward. There are many different cost concepts, and participants in the payments system face significant challenges in accurately identifying all the costs associated with a payment, and allocating costs across the various payment methods.

The main resource cost directly incurred by consumers is the cost of their time to make payments. Consumers also incur charges by financial institutions (and in some cases merchants) for payment services.... Of these various time costs, the easiest to measure is tender time – the time spent at the check-out while the payment is being processed. The estimates below draw on the tender times discussed in Section 4.1, which showed that the fastest processing times are for cash payments, followed by EFTPOS, credit cards and cheques.

Resource link - https://www.rba.gov.au/payments-and.../paymts-sys-rev-conf/2007/7-payment-costs.pdf

Attachments

Last edited: