- Joined

- 17 September 2022

- Posts

- 321

- Reactions

- 362

Or some dudes with a different of opinions about marriageYes nothing at all to do with age but more a matter of awareness

Or some dudes with a different of opinions about marriageYes nothing at all to do with age but more a matter of awareness

You'll have to explain that one.Or some dudes with a different of opinions about marriage

Yes nothing at all to do with age but more a matter of awareness

Why Does Warren Buffett Always Pay In Cash?

If Warren Buffett ever walks into your store or restaurant, he's likely to pay for his purchases in cash.

"I've got an American Express card which I got in 1964," Buffett, who's worth more than $88 billion, told Yahoo Finance last year. "But I pay cash 98 percent of the time. If I'm in a restaurant, I always pay cash."

That's right. Warren Buffett — one of the richest guys in the world — prefers to pay in cash. In fact, he says that he pretty much always carries around about $400 with him. Is it because he's afraid of credit cards? Does he have security concerns? Is he avoiding those annoying late fees and penalties in case he doesn't pay off his balance?

Actually, it's none of those reasons. The explanation is that, for Buffett, paying with cash is "just easier."

Buffett, however, is part of the minority. Each year, fewer and fewer people pay cash when making purchases. In fact, according to a 2017 U.S. Bank survey of more than 2,000 Americans, 50 percent only carry cash about half of the time. Among people who do carry cash, nearly half of them say it's less than $20 and 76 percent say it's less than $50. I'm betting the number of Americans who don't carry cash has likely increased since then.

So there's a growing number of people who don't like to use cash, yet there are still plenty of people like Buffett who prefer to —or have no other choice because they can't get credit. Clearly, we're in a time of transition. Twenty years ago, cash was king. Today it's less so, and 20 years from now it may be gone altogether.

But if you're running a small business in 2020 none of this should matter. Why?

Because you want to make a sale. And the last thing you want to do is to turn a customer away because they're not paying the way you want them to. I frequently run into small businesses around the country that do this. They tell me — the customer — that they only accept cash. Or they have a "minimum credit card purchase" policy. I've also visited other businesses that — despite legislation in towns like Philadelphia, San Francisco and recently New York — only accept credit cards. These people would literally turn Warren Buffett away.

This is not only dumb but also insulting to the customer. Today's consumers all have preferences as to how they want to pay for their purchases. Some, like Buffett, prefer to use cash. Others like credit cards. Mobile payments like Apple Pay (which is on pace to account for 10 percent of all global card transactions by 2025) are obviously becoming more popular. Maybe bitcoin will finally be less volatile in a few years. Maybe we'll be accepting the Yuan as currency in a decade or so. Who knows?

It doesn't matter, though. If you're a small merchant or restaurateur you've got to give your customers the choice. You've got to offer all those options, and you need to figure out how to make it work financially. Sure, there are fees and costs for offering credit cards or mobile payments, but there are easy accounting tricks — like these — to help offset those expenses. Your job is to figure it out. Why?

Because it's the customers' choice. Not yours. You wouldn't want to turn Warren Buffett away just because he prefers to use cash, just like you wouldn't want to turn any customer away just because of the payment method they want to use.

Well, at least not until you've got $88 billion in the bank.

HereticWarren is great, but yeah he is an old guy stuck in certain ways of acting, he grew up using cash, and will continue using cash, the younger generation are growing up with digital payments.

Also, Buffett (and I) own American Express, Mastercard and Visa, I think deep down he is quite happy with a move to cashless payments, especially using Apple devices which we and the other Berkshire shareholders own 5% of.

The Berkshire System is increasing being run by Greg Abel as Warren slows down, and he is pretty good.Heretic

The Berkshire System is increasing being run by Greg Abel as Warren slows down, and he is pretty good.

You right now:

See what happens when you diss the old man.Hahaha… what?

Pepsi has been trying to sell fake coke of yearsthere will always be imitators.

but in reality, I have been watching Greg Abel’s career at Berkshire, and he very good, I added to my Berkshire Recently because of my confidence in him.

Going to be an end of an era once buffet goes. Lest we forget.

but in reality, I have been watching Greg Abel’s career at Berkshire, and he very good, I added to my Berkshire Recently because of my confidence in him.

See what happens when you diss the old man.

Definitely, but it is good to know that it’s in good hands. And Buffett started with a little bit of nothing, Greg will inherit a mighty hand.Going to be an end of an era once buffet goes. Lest we forget

Might be like the apple story. Steve jobs could work a crowd. I can't even remember the guys name that took over off the top of my head. Safe pair of business hands, not much pizazz or innovation. Crowds will possibly drift.Definitely, but it is good to know that it’s in good hands. And Buffett started with a little bit of nothing, Greg will inherit a mighty hand.

None of us want to lose Buffett, but when he does finally lay down his last balance sheet, it’s going to be interesting to watch where the company goes from there.

who knows they may even start paying dividends, I just hope Buffett lasts until the class A shares hit $1,000,000 that would be a great life achievement, to take a stock from $6 to $1,000,000 per share.

Tim Cook over from Steve, and he has been great too,Might be like the apple story. Steve jobs could work a crowd. I can't even remember the guys name that took over off the top of my head. Safe pair of business hands, not much pizazz or innovation. Crowds will possibly drift.

“Cash Day” protest in Australia: How popular are cash payments among Aussies vs other APAC markets?

In protest against Australia’s growing shift towards cashless transactions, pro-cash activists recently organised “Draw Out Some Cash Day” on April 2, which saw large numbers of Aussies flock to bank branches and ATMs to withdraw cash – and demonstrate to financial institutions and retailers that there is still a demand for cash.

But what proportion of Aussies today like using cash when making payments? And amid expert predictions that the country will become completely cashless by 2030, how many Aussies believe that cash will remain a relevant form of currency in the near future? Now latest research from YouGov sheds light on these questions and how attitudes towards cash in Australia compares with other key markets in APAC.

How popular are cash payments among consumers in Australia and across APAC?

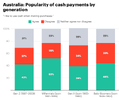

Latest data from YouGov Profiles reveals that over two in five (43%) Aussies like using cash to settle their purchases. This is significantly higher than in Singapore (34%) and Hong Kong (31%), but lower compared to Indonesia (63%) and Thailand (53%) where a clear majority of consumers indicate so.

On the other hand, about three in ten (31%) Aussies prefer making cashless payments, while over a quarter have no clear preference.

Interestingly, Millennials in Australia are significantly more likely than other generations to prefer cash payments. Around half say they like to use cash, compared to around two in five for other birth cohorts.

Do most consumers think that cash will continue to be relevant in the near future?

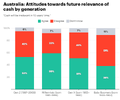

Latest YouGov Surveys research also shows that half (50%) of Aussies think that cash will become irrelevant in ten years’ time. This is lower compared to other APAC markets such as Thailand (61%), Indonesia (57%), Hong Kong (53%) but higher than in Singapore (44%).

In contrast, about two in five (42%) Aussies believe cash will continue to maintain its relevance in the near future, while 8% are on the fence.

Surprisingly, a generational analysis reveals that Millennials in Australia are most likely to believe cash will become outdated in the next ten years, with almost three in five indicating so – despite having the largest proportion who like paying in cash. While more than half of Gen Z and Gen X also think so, most Baby Boomers believe cash will remain relevant in the coming decade.

Wow I just learnt something that I didn't realise.This morning on ABC Australia they had a segment on Cash, they mentioned that studies are showing that using cash instead of tapping helps control a person's spending and helps them save. At the end they asked one of the young ABC interns about it and she said that she always carries cash and uses it because of the exact things that the studies have shown - using cash gives a psychological feeling that causes restraint. She also said that a lot of her friends also use cash.

Funny how we have organisation's spending money on studies, which tell us what we already know.

"Interestingly, Millennials in Australia are significantly more likely than other generations to prefer cash payments. Around half say they like to use cash, compared to around two in five for other birth cohorts."View attachment 178246

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.