- Joined

- 28 August 2022

- Posts

- 7,009

- Reactions

- 11,330

Rabbito I thought it was you rcw as referring to?Who is Irene? Ooops..sending your message to your girl??

Rabbito I thought it was you rcw as referring to?Who is Irene? Ooops..sending your message to your girl??

Sunday for me is not a day of rest. Next wet one will be though????

Got to up now, getting ready to visit a new church (to me) for Sunday service.Sunday for me is not a day of rest. Next wet one will be though

I'm the kind of person who never carries cash.

When I do, I tend to spend it right away since it feel less like spending when the number in my bank account remains unchanged.

That is, until I discovered TikTok's "cash stuffing" budgeting trend, and set out to try it.

What is cash or envelope stuffing?

Young people have discovered cash!

Once a popular savings method, the cash stuffing trend involves withdrawing your weekly or monthly pay in cash.

You then "stuff" your cash into folders, which have designated purposes ranging from savings to rent, petrol, groceries and eating out.

This can be done fairly simply with labelled paper envelopes.

But with more than a billion #CashStuffing views on TikTok, an industry has flourished around it, with aesthetic personal binders, plastic bill organisers and specialised wallets gaining popularity.

The trend is similar to the Barefoot Investor's "bucket" method, but with a soothing ASMR element to it.

In practice, the visual and tactile elements of using cash can help some people create and stick to a budget. This is how trying out the trend worked for me.

Where are all the ATMs?

My cash stuffing experiment had a rocky start.

After pay day, I usually split the money into my various accounts — every day, fun stuff, savings and rent.

But this time, I needed cash, and getting motivated to leave the house and find an ATM was a hassle.

I didn't feel like I could withdraw my whole pay check from a supermarket checkout, so tried to research where else there might be an ATM in my area.

After driving to two different local shopping areas, I finally found an ATM at the back of a restaurant … which charged me a $3 fee.

I felt very conspicuous carrying so many bills, and I couldn't fit them in my wallet with all my cards.

Then it was time to stuff my pay.

I used a texta (fun!) to label my envelopes with groceries, rent, going out, petrol/public transport, and savings for my upcoming car service.

I then took some cash out of my "groceries" and "going out" envelopes, and put it straight back into my wallet. How would I tell which allocated cash amount I was spending on each activity, you ask? I truly have no idea. I refuse to invest in a personalised cash-stuffing wallet.

'Do you take cash?'

My first time paying with cash, I felt a little like I was in a criminal gang. Something about cash is just very suspicious.

Every store I went to, they'd automatically load up the EFTPOS machine, and I'd have to nervously say my new catch phrase: "Sorry, do you take cash?"

I felt immensely guilty paying for my $3.80 coffee with a $20 note, holding up a line behind me.

I had to awkwardly stand by the side at the supermarket's self-checkouts, waiting for a "cash and card" booth to become available.

And having to carry my wallet around was a pain — I'm used to going out with only my phone, and tapping it to pay with my digital wallet.

More money, more thinking

There were some benefits though.

Given I was conscious of the amount of money I had in my wallet, and could see and feel the cash, I thought about what I was spending more.

I also avoided those sneaky 6-cent fees that are often a last-minute addition to card transactions, which are probably costing me in the long-term.

I cash stuffed various paper envelopes, labelled in texta. (ABC Everyday: Rachel Rasker)

I did still go for the occasional online purchase, but I tended to consider it more, knowing that I only had a limited amount in my online account, and that I was meant to be sticking with cash.

All up, I think I spent less money.

We live in a cashless society

As much as I've tried to do this experiment as legitimately as possible, I just don't see how people can live their whole lives with only cash.

I had my "rent" envelope full of cash, but that's an expense I usually transfer online. I don't even know if paying in cash is an option, and if it is, there's no way I'm making the effort to drive to my real estate agent's office every fortnight.

My Opal (transport) card usually auto-refills through my bank too, and purchases like concert tickets or booking holiday accommodation is also online-only.

Even paying back friends for group dinners felt awkward with cash — I never had the right change, and they'd just ask me to transfer them instead.

My bank doesn't have any physical branches — in all of Australia — so I wasn't really sure how to deposit the sum of my savings at the end of the experiment.

But turns out, you can make deposits at some local post offices! And who doesn't love interacting with Australia Post employees.

You could of course keep all of your long-term savings in cash, but that'd mean missing out on interest in your savings account, which could cost you hundreds of dollars a year.

The verdict

I spent less money while experimenting with cash stuffing.

I also hated every minute of it.

Without investing in a specialised wallet, it's hard to know how much you're spending on different things, so the whole 'itemised budgeting' element becomes near impossible.

Sourcing, sorting and spending cash is also so much effort. It might be useful if you're saving for something specific, and are only withdrawing part of your salary to go towards that envelope/event.

It might also work for you if you struggle with traditional budgeting, and prefer to see and touch things.

Modern convenience wins for me — I'll take tapping my phone over carrying cash any day.

'Cash stuffing' saved me money — and I hated every minute of it - ABC Everyday

The 'cash stuffing' envelope trend can help some people create and stick to a budget. I am not one of those people.www.abc.net.au

From your friendly government news network."I spent less money while experimenting with cash stuffing. I also hated every minute of it."

Reading the story, it all sounds rather pointless to me. Low FI/ low FA*"I spent less money while experimenting with cash stuffing. I also hated every minute of it."

Reading the story, it all sounds rather pointless to me. Low FI/ low FA*

*Financial Intelligence/ Awareness

They are basically using Dave Ramsey’s envelope system, I used that for about a year back in my 20’s when I was training the wife, but I like the way I operate now much better, buts it’s good way to teach budgeting to people that don’t like budgeting."I spent less money while experimenting with cash stuffing. I also hated every minute of it."

Barefoot Investor has a similar system "buckets"They are basically using Dave Ramsey’s envelope system, I used that for about a year back in my 20’s when I was training the wife, but I like the way I operate now much better, buts it’s good way to teach budgeting to people that don’t like budgeting.

The idiocy of this line. Makes you worry about spending habits.""I spent less money while experimenting with cash stuffing. I also hated every minute of it."

We have always worked on the proncipal if we can afford it and it is needed then buy it, otherwise it dosn't happen.I think the convenience of card tapping is to great of a pitfall. Cash in envelopes tends to make you save. Yes it's a pain in the arse. But I think you have tendency to save physical over digital.

There are to many online distractions and "must have" items at "discounts". That can be easily blasted away with a card from the comfort of your home.

Yes with me too but not the other half. I need it, I buy it, kept saying don't buy more junks but the on line advert is too gd for others to resist.We have always worked on the proncipal if we can afford it and it is needed then buy it, otherwise it dosn't happen.

Same here Citibank foreign currency accounts direct linked to CC was a wonderful tool, automatically switching to right account no fee even some ATM fees paid by residents were waived .but Citibank Australia now bought back by NAB I think and all these great tools are gone.i will have to close these accounts asapCitibank used to be good for our overseas trip money esp in Europe. However it had close this type of account n we are in the process of either selling the stock now or seeking another bank that have this type of services.

Have overseas stock that paid Div in Euros n had been depositing into that acc for holiday euros spending.

Will investigate CBA ultimate card.

I thought so too. Best to investigate with HSBC, once off for the upcoming China trip n then close it. Don't need that many acc to complicate others when I kick the bucket.Same here Citibank foreign currency accounts direct linked to CC was a wonderful tool, automatically switching to right account no fee even some ATM fees paid by residents were waived .but Citibank Australia now bought back by NAB I think and all these great tools are gone.i will have to close these accounts asap

Hopefully HSBC will be able to replace.

CBA foreign currency are a rip off.avoid..

Hope this helps

His bucket system is different to Dave Ramsay’s envelope, however Barefoot is a fan of Dave Ramsay, I had a chat with him once and it turns out we had both been listening to Dave Ramsay.Barefoot Investor has a similar system "buckets"

CBA foreign currency are a rip off.avoid..

Jade Bury was told to ask friends or family for help until the banking issue was resolved.(Supplied)

Jade Bury was told to ask friends or family for help until the banking issue was resolved.(Supplied)Some customers told the ABC they started regaining access to their online accounts in the afternoon, and others were able to make payWave purchases after lunchtime."Services are recovering following intermittent issues that some customers experienced across our banking services today.

"We can confirm we have identified the cause of the issue and services are being restored.

"Please note there may be delays in some payments as we continue to bring services back online."

These complaints on Twitter were all made after 4:00pm.(Twitter)

These complaints on Twitter were all made after 4:00pm.(Twitter) A sign said there was a limit on cash withdrawals.(ABC News: Emily Laurence)

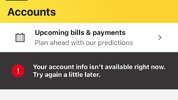

A sign said there was a limit on cash withdrawals.(ABC News: Emily Laurence) Customers sent the ABC screenshots of the error message they received in the CommBank app.(Supplied)

Customers sent the ABC screenshots of the error message they received in the CommBank app.(Supplied)Gerard Brody, the chairperson of the Consumers' Federation of Australia, said the technical outage highlighted some of the problems with moving to a cashless society."We currently have a technical problem with telephone banking and NetBank, which will prevent you from transferring money and paying bills. We're working to resolve this issue as a top priority and apologise for any inconvenience. You may wish to call back later as we are experiencing a high number of calls."

I knew it this morning b4 open time. ATM took my large cash deposit but when I tried to withdraw less than 1k, jt kept saying I exceed my daily withdraw limit, got a fright thinking My acc has been hacked. Kept trying their diff atm with same message. Cldn't even checked my bal but luckily it printed a receipt of my big deposit.Just another minor issue -

Commonwealth Bank outage leaves customers unable to access money, use CommBank online

The Commonwealth Bank has apologised to its customers after a major glitch left them unable to make purchases with their bank cards or access their accounts for hours.

Key points:

Customers received error messages when trying to use the NetBank online banking service and the CommBank mobile app.

- The bank says a "technical problem" prevented people from transferring money and paying bills

- Some customers were unable to pay for fuel or doctor's appointments with their cards

- Services started being restored in the afternoon, Commonwealth Bank said

Some told the ABC it meant they could not pay for essentials like fuel, medications or rent.

Some users also reported problems accessing the bank's financial services arm, CommSec, and other said direct debits for bill payments failed.

Bundaberg woman Jade Bury's card kept declining at a doctor's appointment this morning.

When she contacted the bank's customer service team via Facebook, she was advised to try borrowing money from family or friends.

"I'm just absolutely livid. I don't think it's good enough," she said.

View attachment 158677Jade Bury was told to ask friends or family for help until the banking issue was resolved.(Supplied)

Ms Bury could not pay for her appointment, and she said she would have to go without medication she needs for a bad infection caused by tonsillitis.

"I had to walk away and say I can't pay for my appointment because I didn't have the funds," she said.

"I couldn't access anything … it's quite frustrating."

What caused the CommBank outage, and when will it be fixed?

A spokesperson told the ABC said the outage was caused by an update to an "internal application" used by the bank, which then caused a problem with a server.

In an update posted at 4:00pm AEST, the bank apologised to customers and said:

Some customers told the ABC they started regaining access to their online accounts in the afternoon, and others were able to make payWave purchases after lunchtime.

However, some users still reported issues across the afternoon.

View attachment 158678These complaints on Twitter were all made after 4:00pm.(Twitter)

According to Downdetector, which tracks online outages, hundreds of people were still logging problems with the website and mobile app as of 3:00pm.

Commonwealth Bank did not answer the ABC's questions about how many customers were affected.

The bank is Australia's largest, with more than 15 million customers across a range of services.

About 7.7 million people use the CommBank app, the bank said on its website last month.

Bank branches were open today, but the bank warned customers that they would be busy.

View attachment 158679A sign said there was a limit on cash withdrawals.(ABC News: Emily Laurence)

A sign tacked to the window of a Sydney branch said cash withdrawals were being limited to $300 per customer.

Commonwealth bank customers 'livid' after payments decline

Many customers told the ABC they did not know about the banking outage until they tried to pay for something.

Christopher Curr, who runs a lawn and garden business in Cairns, found out about the outage at the bowser this morning.

"Wasn't able to pay on the card, just kept declining, even though I know there's funds in there so I ended up just paying with cash just to obviously get me through" he told the ABC.

"If I didn't have cash on me, I would've been stuck at the fuel station ... that would have been a nightmare."

He said he did not know if his clients could pay him, and he could not buy material he needed for work.

"I've tried to order mulch for a job on Wednesday — same kind of thing, card kept declining," he said.

"So I'm hopeful it's going to get fixed either today or tomorrow so I can order those materials to do my job."

Ms Bury believes the bank should have notified customers directly via text message, email or the banking app, so that "people like me aren't going to get a shock when we're trying to pay for something".

She plans on changing banks as soon as she can and believes many could join her.

View attachment 158680Customers sent the ABC screenshots of the error message they received in the CommBank app.(Supplied)

Other customers have also taken to social media to air their frustrations, with several sharing Mr Curr's experience of being unable to pay for fuel.

"I am stuck at a petrol station and cannot pay for fuel!!!! My app is not working - how should I pay??? I cannot use my own money, what a disgrace CBA," one Twitter user said.

Earlier in the day, customers calling the bank's telephone banking service were greeted with this pre-recorded message:

Gerard Brody, the chairperson of the Consumers' Federation of Australia, said the technical outage highlighted some of the problems with moving to a cashless society.

"People are reliant on banks to make sure they have their systems right so it's incumbent on banks to compensate people not only for any financial loss, but any severe inconvenience as well," he said.

"I hope that in due course there is a full explanation from the Commonwealth Bank."

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.