- Joined

- 20 July 2021

- Posts

- 12,074

- Reactions

- 16,800

not mine , mine had a distinct red tint ( not sludge ) but not red enough to tempt me to add anything extraGotta love a Friday like that.

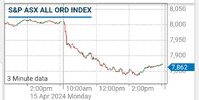

Can count on one hand the number of times intraday portfolio has gone over 10%.

View attachment 164768