- Joined

- 2 October 2006

- Posts

- 3,043

- Reactions

- 2

The sp seems to be in a fairly solid downward trend. Has anyone got an insight as to why? I would have thought that the prospect of positive news re interset in acerage, would have created upward pressure

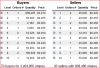

the flow rates are real poor rayw

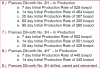

the company pumped up huge ip numbers, then refused to publish 3 monthlys.. so holders were expecting 800 or 1000 bopd where as the wells were actually producing some 350 or less and then declining rapidly.

there is yet to be a commercial well there, the wells will take years to pay themselves off.

if azz is lucky they will be able to drill enough to get a decent price per acre, and maybe salvage some cash back to the holders,,

not sure how the investors at .80 and the cap raising holders in the same region at .80 and recently at .60 are feeling, but my view is that each month the sp is falling away more and more.. its about .37 right now only a short while after a .60 cent cap raising,, pretty scary stuff..

someone told me on another forum to short the share at .80 when i criticised the less than realistic flow rates they put out on the asx as compared to the real flow rates at the rrc.. was great advice really..

most of the small cap oilers have been concerned how badly the investors in the inflated cap raisings would take their losses, and whether it would have a follow on to the other small cap oilers, luckily the others have got their cap raisings off in good time.. but i fail to see where the save will be for azz at this point myself..