wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,893

- Reactions

- 13,161

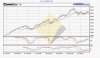

There is a factor in the financial markets that has not been present in previous cycles...............

.................actually there are two. One however was present, but a long time ago.

1/ Bubblevision (Bloomberg et al)

2/ Credit expansion.

I leave the ramifications of these to y'all as self evident.

.................actually there are two. One however was present, but a long time ago.

1/ Bubblevision (Bloomberg et al)

2/ Credit expansion.

I leave the ramifications of these to y'all as self evident.

= Just my thoughts.

= Just my thoughts.