- Joined

- 8 August 2009

- Posts

- 287

- Reactions

- 221

oh the sky hasn't fallen down, Where did all those bears go

Btc just broken 68 758, It's off to the races again,

Another healthy correction of 24%,

cheap money low interest rates ( gatsby era )

That thread is old news by the way, and investors factored that in on Friday ,Interest rates are set (again) to move higher.

BTC needs to break its 50EMA before you can really celebrate.

View attachment 123384

And for those interested: https://nypost.com/2021/04/24/new-federal-regulations-could-spur-cryptocurrency-crash/

A potential risk.

jog on

duc

1. That thread is old news by the way, and investors factored that in weeks ago ,

2. That article has been written by Ray dalio 3 weeks ago,

3. And FYI the 50ema is on daily, might want to pull that out on the weekly charts and take another look,

My point is simple if u read my last posts , I remain bullish and accumulated more crypto in the last correction (weekend past)1. You cannot factor in a risk. You can manage a risk.

2. The risk, until it is no longer a risk, remains a risk.

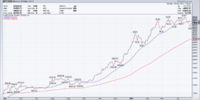

3. Weekly:

View attachment 123392

Your point is?

jog on

duc

1. My point is simple if u read my last posts , I remain bullish and accumulated more crypto in the last correction (weekend past)

2. My point is that if you look at the weekly charts not the daily we clearly are still in a bull run !

3. My point is I'm clearly optimistic at the current point with crypto markets,

4. And you are clearly not ?

5. Respectfully different opinions,

6. I remain bullish at this point of time ,

7. And you are bearish with main stream media .

There is nothing to suggest ( other than an oversold bounce) that correction has completed......oh the sky hasn't fallen down, Where did all those bears go

Btc just broken 68 758, It's off to the races again,

Another healthy correction of 24%,

cheap money low interest rates ( gatsby era )

Quote "Does this chart not make you at least a little nervous in the short term?"1. Which is fine and I hope it does well.

2. Correct. The weekly chart is bullish. However, in different time frames, you can have different trends. The Daily trend is bearish, until proven otherwise. To prove it otherwise, price needs to trade back above the 50EMA and hold it, then trade higher past the previous high. If it fails at the 50EMA, then the Daily trend remains bearish, all within a Weekly bullish trend.

3. Optimistic and not a little biased.

4. I am indifferent (as I have no position) and merely stating the blindingly obvious, as per pretty bog standard TA.

5. I have no 'opinion'. As I said, I am simply stating the facts as they appear on the charts.

6. Clearly.

7. Incorrect. I am as I said neutral. The mainstream media have highlighted 'potential' risks. Those risks may never eventuate or be completely wrong. To not consider them however is foolhardy.

Does this chart not make you at least a little nervous in the short term?

View attachment 123396

jog on

duc

So you still trading this plan ?Looks to be a textbook EW impulse pattern completion. If count is correct we might be in the early stages of a pullback under 35K or the span of the previous wave 4 (blue) of one less degree.

More importantly this might also be a warning for an imminent stock market correction as BTC movements have been preceding indices of late. Ending diagonal pattern that developed last few weeks suggested imminent pullback ahead

View attachment 122961

Quote "Does this chart not make you at least a little nervous in the short term?"

No your monthly chart does not. Nor do i look at monthly charts to plan my trades , I actually use 5/15min /1hr/4hr ,Daily charts and weekly if i need to pull back to look at the overall perspective.

I will post my trading plan for Btc , which was posted on this thread 3 days prior to the leg down. So i actually forecasted a second leg down.

It broke the 68 334 which i honestly thought that leg would hold. Nether the less, The general consensus or theme doesn't change for me.

I think this was a healthy correction for btc , Consolidation will take place before it moves to test new heights.

3. Agreed bullish , tho i am not biased ( i dont personally hold btc) Tho i use btc to gauge where the general market goes.

Yes I am. I should note that I sold ETF BTCE . So the price targets mentioned above are in BTC/EUR.So you still trading this plan ?

Curious !

The correction is over ,Yes I am. I should note that I sold ETF BTCE . So the price targets mentioned above are in BTC/EUR.

I think it's important to have a handle on the degree of trend the market is currently in. Still don't think that the correction over and that we will eventually get another leg lower after this upward b wave completes thats if it has not completed already.

We had a very strong 3rd wave up the last 6 months and the subsequent correction is gonna take quite a while relative to the time it took that 3rd wave to complete.

For now I just follow the buy/sells my system generates

The correction is over ,

please relate to 2017 charts,

This is simply a change from bitcoin domaince to altcoins,

Check the market cap

This happened in 2017

Btc will go sideways , pretty much consolidate and move like the stock market.

money will slowly move out of bitcoin for the shorterm and move to alt coins.

So my trading pattern is still bullish as I have heavily invested in alt coins.

So i see btc swinging slowly in between 65k -73k over the couple of months as alt coins will be the play now and then back to btc for its last stage of parabolic before everything blows up.

So i still think we have 3-4 months of this bull run to play out

Refer to market cap,

Market cap still growing tho btc giving up over 10% , this will continue, currently the flow of money moves out if btc and into alts coins

I trade with a plan,Hope your right about the altcoins, so far they seem to be shadowing btc

I trade with a plan,

And being right can be no guarantee! No crystal ball sorry!

Only a salesman would do that.

I trade with my plan , with stop loss in place and have alot invested as attached.

We will see how this plays out!

Pls this is not finacial advice and lls DYOR

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.