wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,012

- Reactions

- 13,350

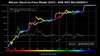

~400USD seems to be a solid resistance level. A solid break from that and we're off to the races again.

I'm still like a new add a new gate with all this stuff but I certainly think the ETH story is solid, as far as my limited understanding is. (Along with BTC of course)