- Joined

- 14 March 2006

- Posts

- 3,630

- Reactions

- 5

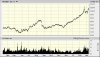

Got into these guys last week.

Looking great value at present.

The majority of their cash is deposits in local branches. Unlike the majors they are looking into agriculture/regions and the future. Nice!

Looking great value at present.

The majority of their cash is deposits in local branches. Unlike the majors they are looking into agriculture/regions and the future. Nice!