- Joined

- 17 August 2006

- Posts

- 7,811

- Reactions

- 8,429

Posting this one up as it may well be a Ballsup

Of course, I may also be a genius

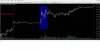

It is a discretionary idea to hedge trade the Pound Aussie against the Euro Aussie based on the relative strength of the Euro Pound

Currently seeing short term strength in the Aussie with a weakening "retracement" in the EUR/GBP ....

The concept is to short the EUR/AUD and hedge with Longs on the GBP/AUD, depending on the position of the EUR/GBP (daily position)

Currently a few pips down, but that is the nature of a scale in trade ... we shall see what eventuates

Of course, I may also be a genius

It is a discretionary idea to hedge trade the Pound Aussie against the Euro Aussie based on the relative strength of the Euro Pound

Currently seeing short term strength in the Aussie with a weakening "retracement" in the EUR/GBP ....

The concept is to short the EUR/AUD and hedge with Longs on the GBP/AUD, depending on the position of the EUR/GBP (daily position)

Currently a few pips down, but that is the nature of a scale in trade ... we shall see what eventuates