Gday

I am about to read through the Wyckoff course for the second time.

This time taking notes.

I am also finishing up master the markets for the second time.

I have also been paper trading with success on Stockwatch and ASX game.

The question:

Can I backtest These strategies . I have incredible charts only , but will get Amibroker if needed.

The intention is to hold for 2 days to 60 trading days [3 months]

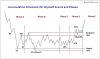

mainly buying close to support after low volume test after background of high vol accumulation on markdown ,followed by accumulation then low vol test of supply.

Expected rally top will be calculated using previous rally range and my own method of calculation. Possibly confirmed with P&F

So how do I backtest a stock that is stronger than its sector, in a neutral , bullish or bear market, off support after large vol markdown followed by solid accumulation , with a low volume test for supply!!!!! oh almost forgot current price below 200 Day MA.

Not to mention my Manual trailing stop strategy that tightens at the first sign of weakness after trailing below previous days open on up bars!!

Would like to trend trade if the opportunity exists too [think A2m ]

I would like to test at least 100 trades in the 3 types of markets. that's 300 trades.

I understand 10,000 tests would be better but if I can only do this manually that might take a while

Or should I just be happy with my paper trading results in this sideways market and keep drip feeding my CFD account ? I have the minimum in there now and could take some very small positions .

However I would really like some numbers to give me an idea how I might expect to perform.

Appreciate any help

Brendan

I am about to read through the Wyckoff course for the second time.

This time taking notes.

I am also finishing up master the markets for the second time.

I have also been paper trading with success on Stockwatch and ASX game.

The question:

Can I backtest These strategies . I have incredible charts only , but will get Amibroker if needed.

The intention is to hold for 2 days to 60 trading days [3 months]

mainly buying close to support after low volume test after background of high vol accumulation on markdown ,followed by accumulation then low vol test of supply.

Expected rally top will be calculated using previous rally range and my own method of calculation. Possibly confirmed with P&F

So how do I backtest a stock that is stronger than its sector, in a neutral , bullish or bear market, off support after large vol markdown followed by solid accumulation , with a low volume test for supply!!!!! oh almost forgot current price below 200 Day MA.

Not to mention my Manual trailing stop strategy that tightens at the first sign of weakness after trailing below previous days open on up bars!!

Would like to trend trade if the opportunity exists too [think A2m ]

I would like to test at least 100 trades in the 3 types of markets. that's 300 trades.

I understand 10,000 tests would be better but if I can only do this manually that might take a while

Or should I just be happy with my paper trading results in this sideways market and keep drip feeding my CFD account ? I have the minimum in there now and could take some very small positions .

However I would really like some numbers to give me an idea how I might expect to perform.

Appreciate any help

Brendan