- Joined

- 28 March 2006

- Posts

- 3,565

- Reactions

- 1,303

Follow up from my post above

https://www.aussiestockforums.com/f...t=3117&page=56&p=803728&viewfull=1#post803728

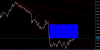

Around the target area now and trying to change direction with a potential breakout on the 15 min chart.

Daily chart below - click to expand

https://www.aussiestockforums.com/f...t=3117&page=56&p=803728&viewfull=1#post803728

Around the target area now and trying to change direction with a potential breakout on the 15 min chart.

Daily chart below - click to expand