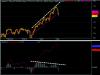

Well i use CCI 13 bar chart to get a look forwards and there has been a bearish diverence for 6 days before the turn of the $A.

Software says down to about $1.04.

However I am still trying to put the future into perspective, but may die first.

Cheers

Software says down to about $1.04.

However I am still trying to put the future into perspective, but may die first.

Cheers