- Joined

- 17 January 2007

- Posts

- 2,986

- Reactions

- 32

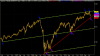

Good analysis.. our currency mainly hinges on commodities and therefore China.. but this in turn depends on the US, the DOW, and the US economic situation in general.

People such as Australian politicians seem to think China exists in a vacuum, but as soon as Walmart stop placing orders at their Chinese factories (as during the GFC), things start getting grim indeed.

Unfortunately, our whole economic policy and fed budget hinges only on China's continued expansion and growth.. like it will continue on forever exponentially.. if only it was that simple.

I would lump Japan into the mix of things as a major trading partner with significant problems also ie just announced that they are officially back in recession. Japans reliance on domestic credit for funding took a big hit due to natural disasters so the timeline for the day of reckoning for them has been shortened by a few years, so they will face an even bigger financial crisis than they have now?

Gross domestic product shrank 0.9pc quarter-on-quarter over January to March, after a 0.8pc fall in the previous three months. Two consecutive quarters of falling output represents an economy in recession.

With a national debt twice the size of its economy and an ageing population, Japan was struggling even before the quake took out infrastructure along its northeast coast and caused power outages.

Consumers have cut back more than expected in the wake of the disaster, throwing doubt on assertions from policymakers that the main challenge is disruption to supply chains.

As for China, so long as they have $US3Trillion freshly printed US dollars to get rid of they can go for a lot longer. That is, so long as the USD doesn't implode........then China will have diddly squat.......we will have even less?

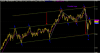

Until then, trade the actual, even if overbought.........and decimating Aussie manufacturing.

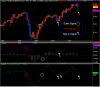

What also hasn't been factored in is an interest rate CUT due to the deepening 'other half of the economy' recession - talk to any retailer how good the mining boom has been to them!