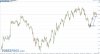

Line in the sand for Aussie imho.

Trade up from here for one final drive higher.

Trade down from here, looking for a re-test to finally go short on the comdolls!

I took a couple of spec longs here at this line in the sand, the premise being these previous lows should act as a resistance becomes support, but no guarantees in this game.

I like this play because it seems like the bigger players are just trying to paint the chart into looking scary, but maybe it really is scary and I'm just stupid.

Context:

* Aussie is tanking today with correlation desks once again following the NZD down after NZ PMs comments that a recession there might be unavoidable.

* Aussie Q4 GDP reported much better than expected today, although the Q3 results were revised down.

* My interpretation of the liquidity sentiment today is that retail and hedge fund accounts (liquidity consumers) were the responsible short sellers, banks (liquidity providers) bought the dip.

I don't think it will take too long to know for sure, and one last shoot for 1.03 is worth the RR to me. If it doesn't work out there will be plenty of pips to the downside.

Trade up from here for one final drive higher.

Trade down from here, looking for a re-test to finally go short on the comdolls!

I took a couple of spec longs here at this line in the sand, the premise being these previous lows should act as a resistance becomes support, but no guarantees in this game.

I like this play because it seems like the bigger players are just trying to paint the chart into looking scary, but maybe it really is scary and I'm just stupid.

Context:

* Aussie is tanking today with correlation desks once again following the NZD down after NZ PMs comments that a recession there might be unavoidable.

* Aussie Q4 GDP reported much better than expected today, although the Q3 results were revised down.

* My interpretation of the liquidity sentiment today is that retail and hedge fund accounts (liquidity consumers) were the responsible short sellers, banks (liquidity providers) bought the dip.

I don't think it will take too long to know for sure, and one last shoot for 1.03 is worth the RR to me. If it doesn't work out there will be plenty of pips to the downside.