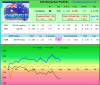

thanks for the diagram peter. i don't know if they are percentages taken from winning trades or what but it is interesting to note that the pullback trade is your main shot (i assume you mean a pullback from a breakout). would like to ask you something, again if you don't mind: i've been paying attention to market depth as you do and i'm wondering if there is a setup that looks good (chart wise) that we would like to take but the depth is badly against us then should we take it? or perhaps the depth can change very quickly so we shouldn't worry too much about it and if the setup looks good go for it?

the market has been horrible hasn't it, terrible for a newby trader

the market has been horrible hasn't it, terrible for a newby trader