- Joined

- 12 January 2008

- Posts

- 7,408

- Reactions

- 18,524

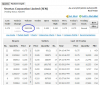

Trading update: EOD

One down day (-1.5%) doesn't change the daily trend, which is up. Selling the short term large cap trades provides cash for others.

JHX and CTX: These didn't bounce on the close at all. They were thumped.

AGI: Sell on the next open. This one is not going up just yet. Keep on eye on it though. I'll re-buy >2.80 if price doesn't close below 2.60.

Comment: As I've mentioned (as has tech/a and Pavilion103) getting out quickly is a requirement for a portfolio like this (*). The entries on both JHX and CTX were perfect. Prices went higher immediately and they added almost 2% to the open profits. Another up day and they might have hit their profit targets. JHX was very close. Not to be.

As we've seen today, a down day in the US markets and a down day in the ASX sees their prices drop quickly. We exit these trades as quickly as we start them. I don't see any reason to wait another day (and hope they go up tomorrow).

Those trades didn't provide anything, but this market dip creates other opportunities. There's a small price consolidation out there waiting for us to find it and trade it.

* If you can't sell or buy quickly then this style of trading is not for you. There's nothing wrong with using a more relaxed style. In fact if it feels better for you then you should do it.

One down day (-1.5%) doesn't change the daily trend, which is up. Selling the short term large cap trades provides cash for others.

JHX and CTX: These didn't bounce on the close at all. They were thumped.

AGI: Sell on the next open. This one is not going up just yet. Keep on eye on it though. I'll re-buy >2.80 if price doesn't close below 2.60.

Comment: As I've mentioned (as has tech/a and Pavilion103) getting out quickly is a requirement for a portfolio like this (*). The entries on both JHX and CTX were perfect. Prices went higher immediately and they added almost 2% to the open profits. Another up day and they might have hit their profit targets. JHX was very close. Not to be.

As we've seen today, a down day in the US markets and a down day in the ASX sees their prices drop quickly. We exit these trades as quickly as we start them. I don't see any reason to wait another day (and hope they go up tomorrow).

Those trades didn't provide anything, but this market dip creates other opportunities. There's a small price consolidation out there waiting for us to find it and trade it.

* If you can't sell or buy quickly then this style of trading is not for you. There's nothing wrong with using a more relaxed style. In fact if it feels better for you then you should do it.