- Joined

- 12 January 2008

- Posts

- 7,408

- Reactions

- 18,524

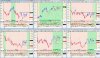

API: I was watching those last three bars, the retest of the low (1.45), but not enough volume done on that last bar to convince me the low is support.

-----------------------------------

Trading update:

New trade: Bought DNA today as it closed above 0.80 yesterday (SL 0.72).

SRF: On watch list, missed out due to very low market depth.

CDA: On watch list, Very thin bid depth also. I can buy it but will I be able to sell it when I want to.

-----------------------------------

Trading update:

New trade: Bought DNA today as it closed above 0.80 yesterday (SL 0.72).

SRF: On watch list, missed out due to very low market depth.

CDA: On watch list, Very thin bid depth also. I can buy it but will I be able to sell it when I want to.