- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,523

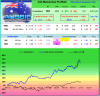

Here's another one that got away. Price opened above my limit order and it's off and gone.

It didn't appear in yesterday's 10d BO scan because of the down day and price was below prior day's close. Noticed it last night and placed limit order that was treated with contempt by the other buyers.

There are always enough opportunities around to not worry about the ones that get away.

I won't fill the thread with the ones that got away. I only mention it as we recently discussed that this will happen when we use limit orders to enter our trades. Chasing price that opens 0.30 above our limit order changes the RR too much for me.

It didn't appear in yesterday's 10d BO scan because of the down day and price was below prior day's close. Noticed it last night and placed limit order that was treated with contempt by the other buyers.

There are always enough opportunities around to not worry about the ones that get away.

I won't fill the thread with the ones that got away. I only mention it as we recently discussed that this will happen when we use limit orders to enter our trades. Chasing price that opens 0.30 above our limit order changes the RR too much for me.