- Joined

- 23 October 2014

- Posts

- 225

- Reactions

- 214

Hi Peter

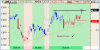

It looks like DMP might be a good contender.

It has gapped above horizontal resistance and above MA200, after a couple of weeks trading in a tight range.

It also had a good run up to this resting point.

The RR looks decent.

I know this stock is well shorted, which could help with the momentum - up or down!

What do you reckon?

It looks like DMP might be a good contender.

It has gapped above horizontal resistance and above MA200, after a couple of weeks trading in a tight range.

It also had a good run up to this resting point.

The RR looks decent.

I know this stock is well shorted, which could help with the momentum - up or down!

What do you reckon?