- Joined

- 12 January 2008

- Posts

- 7,411

- Reactions

- 18,535

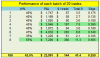

is the reason for using CFD's to increase returns?

No, definitely not. Cfds allow us to use 10-20% of the value of the parcel instead of 100%. This is helpful when the parcel sizes are larger than usual.

If we have cash available we can start more trades if the existing trades prove themselves profitable.

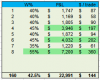

Currently the portfolio is 113% invested and we still have 14K left to use.