- Joined

- 12 January 2008

- Posts

- 7,411

- Reactions

- 18,535

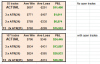

Trading update: New trade

BLD: After closing this trade five days ago when the price dropped, we have re-bought today at 5.51 as price traded back at 5.50. I mentioned the possibility of a re-entry if price reversed quickly. The setup is our standard BO-HR (5.50). The only wrinkle is that the position size is limited to our max size (20%) due to the tight iSL (5.30).

There'll be no re-entry into KDR any time soon as price has fallen further.

BLD: After closing this trade five days ago when the price dropped, we have re-bought today at 5.51 as price traded back at 5.50. I mentioned the possibility of a re-entry if price reversed quickly. The setup is our standard BO-HR (5.50). The only wrinkle is that the position size is limited to our max size (20%) due to the tight iSL (5.30).

There'll be no re-entry into KDR any time soon as price has fallen further.