- Joined

- 30 September 2012

- Posts

- 743

- Reactions

- 385

I never get to go all in after a crash (unfortunately), or at a peak (fortunately). I'm always all in.

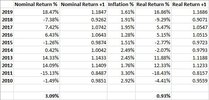

Empirical evidence (related to my style of investing) convinces me that I'm probably better off all in over a long period of time.

Empirical evidence (related to my style of investing) convinces me that I'm probably better off all in over a long period of time.