- Joined

- 8 June 2008

- Posts

- 13,768

- Reactions

- 20,581

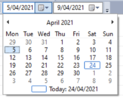

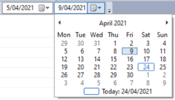

Did you do a typo here on your interval. A 4 day period for weekly? That might explain weird results..or is it a US date format? But then why 5y chosen 10y+ ago?I'm having some confusion with my watch list data. I'm using Amibroker with Norgate ASX Platinum.

When I run an exploration 05/04/21-09/04/21 weekly periodicity over the All Ords, I receive 499 results however when using All Ords past & current I receive 827. I think I may have missed something fundamental but I thought the two explorations should return the same number of tickers?

As a test I'm using the following exploration code:

Code:Filter = 1; AddColumn(Close,"Close",1.5);

Apologies if this is really dumb, however would appreciate any thoughts.

Cheers

Thanks for the thoughts qldfrog. I use the date selector in Amibroker, so the dates are monday-friday from April 2021 and periodicity set as weekly.. I've reached out to Norgate as well but waiting on a response..Did you do a typo here on your interval. A 4 day period for weekly? That might explain weird results..or is it a US date format? But then why 5y chosen 10y+ ago?

This is still not right, i do not believe you can run a weekly system on five days,Thanks for the thoughts qldfrog. I use the date selector in Amibroker, so the dates are monday-friday from April 2021 and periodicity set as weekly.. I've reached out to Norgate as well but waiting on a response..

View attachment 123250View attachment 123253View attachment 123254

But when I look at the Explore for the previous day and match it to the Backtester Buys

Here's a simple but time consuming workaround allowing Amibroker to read 2020 EOD data until your vendor starts sending data in the correct format.

Open a daily EOD data file in a simple text editing program (not Word).

Select and copy date segment from one of the ticker lines. For example Jan 2, 2020 will look like this200102. 200110. Fridays data

Go to menu "Find and Change" or similar.

Enter find: 190819

Enter change to: 20200110

Press "Change All" or similar

Save

All date events for every ticker in the daily EOD file are now in correct format.

Repeat this for each daily file.

Complain to your data provider to supply data in four digit format for the year.

notepad++ is free and ok for this to work you need to replace 190819 with this 20200110 this works with comsec data save file and install with wizard this hint was taken from here https://forum.amibroker.com/ i have no problems from Norgate date

I enter everything into my AFL code to make sure the settings are the same every time I run a back test.Hey all,

A quick question. When you are coding up your systems in AmiBroker do you code in your backtest settings to your system using the SetOption(), SetTradeDelays() and SetPositionSize() functions OR do you set your backtester settings in the analysis window for a specific system, save it as an .abs file, and then just load it up when you're running a backtest?

Does it matter which way you do it?

as @BoNeZ has stated, you should include it. If you don't specify it in the code then AB will use whatever default's you have in the Settings area. when you start writing more systems you will end up just copy/paste/edit this code anyway. it will give uniformity when tested elsewhere too.Hey all,

A quick question. When you are coding up your systems in AmiBroker do you code in your backtest settings to your system using the SetOption(), SetTradeDelays() and SetPositionSize() functions OR do you set your backtester settings in the analysis window for a specific system, save it as an .abs file, and then just load it up when you're running a backtest?

Does it matter which way you do it?

As others have said. It's very easy to accidentally modify settings while testing other ideas and forget to change things back before running your live system. Putting the settings into your code removes as much human error as possible.Hey all,

A quick question. When you are coding up your systems in AmiBroker do you code in your backtest settings to your system using the SetOption(), SetTradeDelays() and SetPositionSize() functions OR do you set your backtester settings in the analysis window for a specific system, save it as an .abs file, and then just load it up when you're running a backtest?

Does it matter which way you do it?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?