- Joined

- 8 June 2008

- Posts

- 14,055

- Reactions

- 21,156

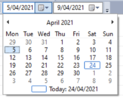

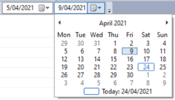

Did you do a typo here on your interval. A 4 day period for weekly? That might explain weird results..or is it a US date format? But then why 5y chosen 10y+ ago?I'm having some confusion with my watch list data. I'm using Amibroker with Norgate ASX Platinum.

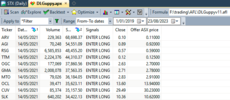

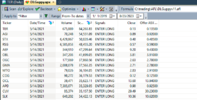

When I run an exploration 05/04/21-09/04/21 weekly periodicity over the All Ords, I receive 499 results however when using All Ords past & current I receive 827. I think I may have missed something fundamental but I thought the two explorations should return the same number of tickers?

As a test I'm using the following exploration code:

Code:Filter = 1; AddColumn(Close,"Close",1.5);

Apologies if this is really dumb, however would appreciate any thoughts.

Cheers