- Joined

- 8 October 2010

- Posts

- 129

- Reactions

- 0

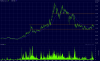

Further to previous post, ASCI has issued monthly report tonight, and recommends subscribers sell ALK along with a couple of other stocks. I personally think this is premature as this stock is a good prospect.

Might present good buying opportunity

Might present good buying opportunity