nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

A-REIT Sector: Weekending Friday 27 May 2016

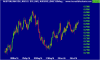

The A-REIT Sector continued to move sideways last week. Still plenty of volatility among the stocks making up the sector.

I updated the Shares on issue; Earnings; Distributions; and Asset backing per share in the tables. It was interesting in seeing that some of the earnings figures had increased substantially where distributions barely changed (if at all). Also some earnings had decreased where the number of shares on issue remained the same. The drop in earnings per share being due to an overall drop in earnings rather than a dilution of earnings through the issue of more shares. The reporting season is drawing very close. I won't be surprised to see some share prices pushed back when the companies report lower than expected earnings.

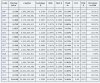

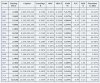

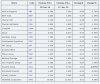

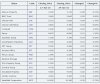

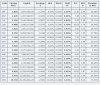

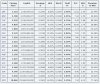

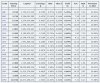

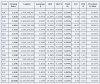

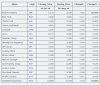

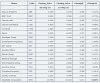

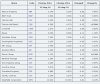

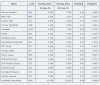

The A-REIT Table for closing prices for Weekending 27 May 2016 follows:

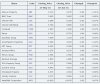

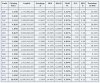

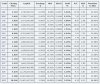

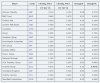

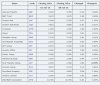

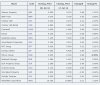

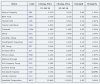

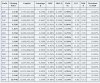

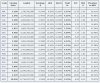

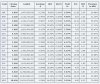

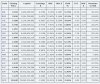

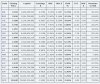

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 27 May 2016, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 27 May 2016. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. The share codes listed in both Tables now hyper-link to the last page (mostly) of the corresponding ASF thread for that share.

5. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck .

.

The A-REIT Sector continued to move sideways last week. Still plenty of volatility among the stocks making up the sector.

I updated the Shares on issue; Earnings; Distributions; and Asset backing per share in the tables. It was interesting in seeing that some of the earnings figures had increased substantially where distributions barely changed (if at all). Also some earnings had decreased where the number of shares on issue remained the same. The drop in earnings per share being due to an overall drop in earnings rather than a dilution of earnings through the issue of more shares. The reporting season is drawing very close. I won't be surprised to see some share prices pushed back when the companies report lower than expected earnings.

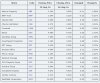

The A-REIT Table for closing prices for Weekending 27 May 2016 follows:

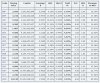

The comparison table of this weeks closing prices versus last weeks closing prices follows:

Comments:

1. The shares listed in the tables above make up the XPJ A-REIT Property Sector.

2. The "Capital" figures in the above tables are "market capital" based on the "issued shares" as distinct from "free float capital". The "issued shares", updated as at 27 May 2016, can change from day to day due to active share buy-back programs and other factors.

3. The "Earnings", "Distribution" and "NTA" figures have also been updated as at 27 May 2016. "NTA" figures are subject to change every time there is a property re-valuation and the table may be out by a few cents from time to time, which effects the "Premium to NTA" also.

4. The share codes listed in both Tables now hyper-link to the last page (mostly) of the corresponding ASF thread for that share.

5. Inclusion of any share details in the above tables is not an endorsement of that share as a viable investment or possible trade.

Disclaimer: These tables may contain errors and should not be relied upon for investment decisions. As always, do your own research and good luck

Last edited: