- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Now that's a decent and rewarding dividend! Considering the price of the share. That seems to be a good yield

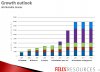

If that were the whole story GumbyLearner, unfortunately the two 50c dividends, SACCS and final $16.95 payment make up the cash for the whole company, per share ($18). Most now want between $24 and $27 based on the fact that coal sales should treble, and there may be some swords crossed and blood drawn in the months ahead.

BHP Billiton is seen as the one and only white night and their mail boxes are said to be jammed with pressures from many sources to make a cash and shares bid.