Sdajii

Sdaji

- Joined

- 13 October 2009

- Posts

- 2,146

- Reactions

- 2,307

that was just one small ( border-line critical mass )device

Russian has THOUSANDS of much bigger warheads and the new hyper-sonic ones don't even seem to need a payload the heat/plasma triggers the reactions in the target area

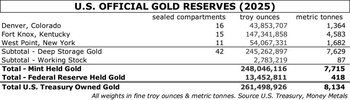

but since Russia hasn't threatened that , MAYBE they believe the vaults are virtually empty

do they sit around in storage , and are NOT moved from bay to bay to settle major account moves

now i still think the bars are just heavily over-committed , but until the forensic audit .. the rumors and theories will multiply for example how much stolen gold ( from other nations is in there) .. somebody looted Iraq and Libya

Entirely valid point about modern nukes being far heftier than Little Boy, but still, the gold at Fort Knox is held in a subterranian vault, not just sitting in a building on the surface.