Dona Ferentes

eidetic cartographer

- Joined

- 11 January 2016

- Posts

- 17,495

- Reactions

- 23,978

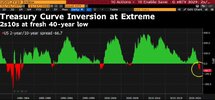

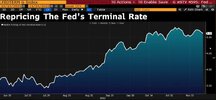

A few slides from a presentation. Markets have over the past year consistently underestimated inflation, and interest rates. From US data

View attachment 149721

they have been probably been listening to ( Ronnie James ) Dio when collating the data , my bet is the song was Dream OnA few slides from a presentation. Markets have over the past year consistently underestimated inflation, and interest rates. From US data

View attachment 149721

As my favourite (and I suspect only correct) financial commentator Jeff Snider of https://eurodollar.university likes to say, nominal values in money markets (bonds, swaps, STIR, etc) shouldn't be taken literally. They aren't actually forecasts on the nominal value of the rate, no matter what the media says. But rather they model a probability distribution of possible outcomes.

The useful information is largely contained in viewing the level of rates through the lens of the slope of the curve.

In that sense, despite the first graph being created by its authors to imply the markets were wrong about inflation, one might argue that given the persistent inversion (despite rising levels) of the forward curve as far back as Jun '21, that curve was (as usual) quite prescient in relation to the subsequent collapse in meme stocks, growth/momentum vs value, many industrial commodities, lumber, inflation protected securities, REITs, many currencies (especially EM), Asian stocks, flattening/then inversion of the 2's10's and now the 3m's10's etc.

Imagine surveying this carnage and thinking the Jun '21 deeply inverted curve was "underestimating" anything...then look at that Oct '22 curve and ? what it's saying about the markets implied probability distribution for the future...

What about us, Australia?Black friday looking to be abysmal this year after disposable income's taken the almighty hit that it has over the last year.

Sales numbers estimated to be about 1/3rd lower than last year. Ouch. Adobe analytics do a piece on this every year, I'll see if I can find it.

Edit:

View attachment 149749

Not looking good on the raw numbers and particularly not looking good once you factor in inflation.

Inflation adjusted numbers are negative/contractions.

but are they buying discretionary items or buying ( forward-buying ) essential itemsWhat about us, Australia?

I had to go to a shopping centre today and I have never seen it so busy.

People certainly seem to be spending.What about us, Australia?

I had to go to a shopping centre today and I have never seen it so busy.

depends on the couple's income and job stability , say two years living/renovating , rent out the house and on to the next/job/city/house ( keeping the house as investment/future developmentPeople certainly seem to be spending.

Late last year a house near me sold. Nothing fancy, just a ~50 year old 3 bedroom house and it's a young couple who've bought it.

Since then there's been at least $25k worth of renovations done that I know of and none of which could be deemed essential. Nice to have but not essential.

Now I'm not judging to be clear, just observing that there seems to be money around. No way I could've afforded to spend like that at the same age.

trueIt was the black friday sales guys.

Depends what you're buyingtrue

and over-stocked items after the lock-down disruptions

going to be some intriguing figures next half-year from the retail sector

but if they are disappointing , is it worth the gamble of buying cheap ??

Looking at the idiot Box's news tonight something in China is starting to give/break massively, or it appears to be, demonstrations demanding a return to normal. Shades of 1989 when it last happened with dire consequences for those involved and the population in general. this is going to be an interesting saga unfolding.Another NRGU buy at 570. There's actually a lot of talk of the west sending vaccines china's way. Considering how shite the chinese vaccine is and how the lockdowns are wrecking their economy, something's going to give eventually and western vaccines might be it.

The only thing certain is that they *cannot* go on the way they are.

Looking at the idiot Box's news tonight something in China is starting to give/break massively, or it appears to be, demonstrations demanding a return to normal. Shades of 1989 when it last happened with dire consequences for those involved and the population in general. this is going to be an interesting saga unfolding.

Is it on purpose as suggested before to flush out tge "bad seeds" or a top rivalry vs Xi?Looking at the idiot Box's news tonight something in China is starting to give/break massively, or it appears to be, demonstrations demanding a return to normal. Shades of 1989 when it last happened with dire consequences for those involved and the population in general. this is going to be an interesting saga unfolding.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.