- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

I thought I'd create a specific thread for discussion of EW and the XAO....

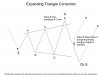

Since the 21st Nov 08, each of the larger legs on the XAO has been moving in 3 wave patterns - corrective waves. The most recent leg up (wave C), shows a triangle (wave 'b' circle) for the intervening correction found in 3 waves moves. This triangle implies the trend is about to change so watch for 5 waves up (or an ending diagonal) to complete shortly .

The larger pattern unfolding since the 21st Nov is starting to resemble an Expanding Triangle - found in wave 4 positions. To be valid, the XAO must deliver wave D and E, again as 3 wave moves.

A second consideration is that we are seeing the final push up of a double zig-zag correction (not labeled). The completion would see the downtrend resume, although this is also the same for the expanding triangle scenario for wave D. Either way a new low is expected.

Since the 21st Nov 08, each of the larger legs on the XAO has been moving in 3 wave patterns - corrective waves. The most recent leg up (wave C), shows a triangle (wave 'b' circle) for the intervening correction found in 3 waves moves. This triangle implies the trend is about to change so watch for 5 waves up (or an ending diagonal) to complete shortly .

The larger pattern unfolding since the 21st Nov is starting to resemble an Expanding Triangle - found in wave 4 positions. To be valid, the XAO must deliver wave D and E, again as 3 wave moves.

A second consideration is that we are seeing the final push up of a double zig-zag correction (not labeled). The completion would see the downtrend resume, although this is also the same for the expanding triangle scenario for wave D. Either way a new low is expected.