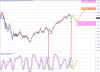

The attached is a 30 min chart of the spi200 showing labeling of a possible W3 down just commenced. Note the corrective abc (zig zag) that has formed over the past 2 days. This wave 3 has a completion target at around 4288. W5 could then take us lower to complete near a strong channel line. Assuming this unfolds the whole move would then be labelled W1 of the larger down move with a W2 bounce then expected.

If the whole move plays out and the impulse wave is clear cut this would be a good clue that the larger move is still down. From my observations and understanding of Elliot all down moves in bull markets are corrective in behaviour and visa versa in Bear markets. Lets see what unfolds.

I am having a problem with my text tool on the software so apologies if you find it difficult to read.

If the whole move plays out and the impulse wave is clear cut this would be a good clue that the larger move is still down. From my observations and understanding of Elliot all down moves in bull markets are corrective in behaviour and visa versa in Bear markets. Lets see what unfolds.

I am having a problem with my text tool on the software so apologies if you find it difficult to read.