Zinc 3M: Daily Chart – Bearish. I now have a good cycle on this that may be of interest to swing traders out there…

Key dates: 28 Feb, 12 March, 17 April, 23 May. (+/- one trading day).

Key prices for lows - 2744, 2514, 2291

While I’d love to say precisely what may happen, I can’t see this commodity clearly (yet).

I suspect a counter trend rally into either 28 Feb or March 17, then a retest of the low, possibly a new major low around 17 April and/or 23 May.

This assumes an Elliott impulse down, not an “ABC” correction. I favour an impulse at this point.

I didn’t look at the chart correctly earlier, (I have been pioneering some time/price variants, and have focussed on cycles to develop them – this obscured the obvious pattern of trend) imposing a minor correction into what I saw, not a major impulse onto the chart, hence my cycle analysis was 180 degrees out of sync.

Timing increments were right, but I got the origin point wrong… translation – this now looks like a bearish campaign to me in Zinc, with the above cycle dates as reference points for tracking the counter trends on the way down.

There may be a bit of sideways activity too – struggling bars up, and strong bars down.

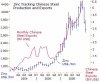

However this is looking in the daily chart. In the weekly chart, this whole move down may be just a counter trend to the secular bullish campaign. Long term investors may see this as a dip in the longer term bullish campaign.

Of course I could be totally wrong about all of this, and I am still developing some radical concepts in T/A, hence this is all experimental at this point, and based on analysis of all the metal charts looking for specific patterns – this is still a work in progress.

Any analysis has its limitations, and Fundamentals that I am not aware of may have an impact I am unable to perceive. Hence, these preliminary comments should not be used as a guide to trade, but are posted for interested parties who trade technically and swing/position trade.

Regards

Magdoran

Key dates: 28 Feb, 12 March, 17 April, 23 May. (+/- one trading day).

Key prices for lows - 2744, 2514, 2291

While I’d love to say precisely what may happen, I can’t see this commodity clearly (yet).

I suspect a counter trend rally into either 28 Feb or March 17, then a retest of the low, possibly a new major low around 17 April and/or 23 May.

This assumes an Elliott impulse down, not an “ABC” correction. I favour an impulse at this point.

I didn’t look at the chart correctly earlier, (I have been pioneering some time/price variants, and have focussed on cycles to develop them – this obscured the obvious pattern of trend) imposing a minor correction into what I saw, not a major impulse onto the chart, hence my cycle analysis was 180 degrees out of sync.

Timing increments were right, but I got the origin point wrong… translation – this now looks like a bearish campaign to me in Zinc, with the above cycle dates as reference points for tracking the counter trends on the way down.

There may be a bit of sideways activity too – struggling bars up, and strong bars down.

However this is looking in the daily chart. In the weekly chart, this whole move down may be just a counter trend to the secular bullish campaign. Long term investors may see this as a dip in the longer term bullish campaign.

Of course I could be totally wrong about all of this, and I am still developing some radical concepts in T/A, hence this is all experimental at this point, and based on analysis of all the metal charts looking for specific patterns – this is still a work in progress.

Any analysis has its limitations, and Fundamentals that I am not aware of may have an impact I am unable to perceive. Hence, these preliminary comments should not be used as a guide to trade, but are posted for interested parties who trade technically and swing/position trade.

Regards

Magdoran