- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

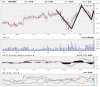

Gday Wavepicker. I went short some today at average price of $27.65. Notice the HUGE volume today, the biggest all month. I think this is primed for a small retracement, back to around $24. Notice the comparatively smaller volume on the way up since late Sep. Big resistance may (and probably already has) arise in this gap refill level, which also happens to coincide with the 61.8% retracement level (see earlier posted chart). I like the longer term prospects of BNB, but I feel it has run the course over the short term.

hello lachlan,

Good luck with your trade, I think this must be getting close, not 100% sure it is there just yet but I do have a fib turn date today (28th Sep) plus or minus one day, so you might be in luck with this one!!. Hopefully the market is plays ball with our thoughts!! Although I consider this a short, I didn't short this today as I am looking at both JBM and STO to short instead in preference, looking to position next week

PS I have attached my take on TAH, I know it differs somewhat from what you have posted, but just another perspective

Cheers